It’s no secret the bank of mom and dad has been a useful tool for first-time homebuyers looking for financial support.

However, an even bigger predictor of homeownership is whether mom and dad own property themselves, according to a new Statistics Canada study.

Canadians born in the 1990s are twice as likely to own a home in 2021 if their parents also owned a property – at least when compared with those whose parents do not property, the national stats agency concluded.

And individuals with parents who owned multiple properties were three times more likely to own a home in 2021 compared with children of non-homeowners.

“Many factors contribute to the ability of younger Canadians to become homeowners, including what some refer to as the ‘great wealth transfer.’ This concept proposes that parents' wealth could – through gifts and inheritances – make it easier for their adult children to afford a down payment or to meet their mortgage payments,” the study stated.

For British Columbians born in the 1990s to property-owning parents, 14.4 per cent owned a home in 2021. That’s the lowest rate among provinces.

New Brunswick led provinces at 20.5 per cent.

“In housing markets with higher property values, where higher incomes are necessary for ownership, parents’ property ownership or wealth plays a larger role in their adult children’s homeownership outcomes,” the study stated.

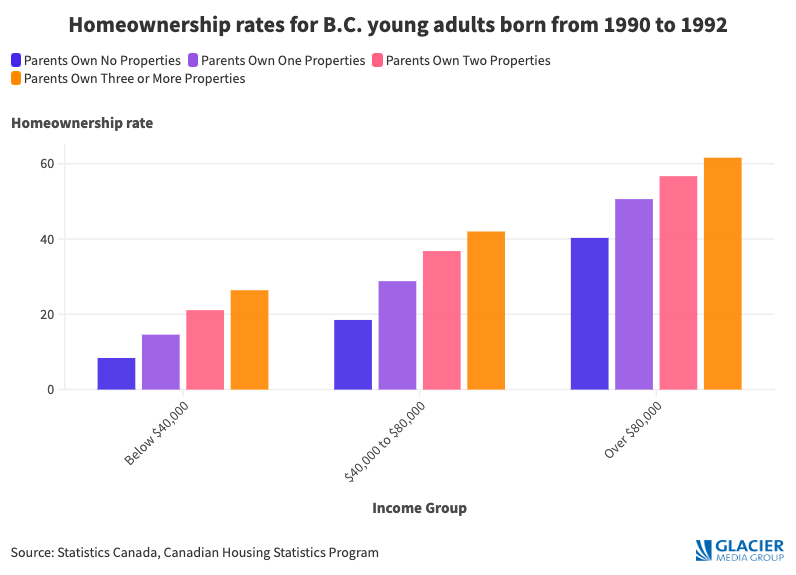

Meanwhile, the study found the rate of homeownership for B.C.’s young adults increased based on the number of properties their parents own, regardless of income.

Statistics Canada said the need to research the transfer of generational wealth has grown alongside housing unaffordability and concerns over the accessibility of homeownership.

There has also been a growing reliance on parental support with the share of first-time homebuyers who received financial help from family rising from 20 per cent to 28 per cent between 2015 and 2021. In addition, the average amount received also increased from around $50,000 to $80,000, according to data from the Canadian Imperial Bank of Commerce cited in the study.

“Financial assistance from parents is one of the channels that can explain differences in homeownership between the adult children of homeowners and those of non-homeowners,” the study stated. “Other possible channels include better access to certain social networks and greater investments in education, which may lead to higher individual incomes for adult children of homeowners.”