A recent national survey labelled Generation Rent reveals that approximately nine million Canadians are settling to rent forever or completely giving up on the idea of homeownership, with the highest percentage in British Columbia.

This comes shortly after RBC Economics released a report showing that housing affordability in Canada is at its lowest in 31 years and hot on the heels of multiple mortgage rate hikes.

The Bank of Canada has hiked its key lending rate three times since March with the largest hike – up by 75 basis points – widely expected on July 13.

Major banks have already increased rates for five-year fixed mortgages – the most popular mortgage option in Canada – to 4.73 per cent, up from 2.87 per cent at the start of this year.

A 75-basis point increase, combined with higher bond yields which affect long-term rates, could push five-year mortgage rates to 5 per cent with weeks, analysts say.

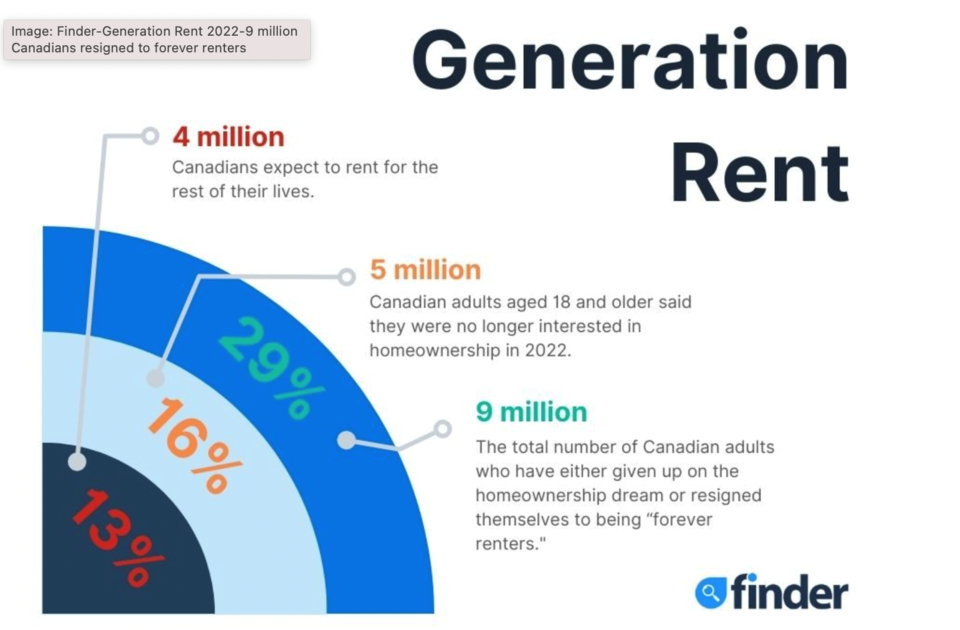

In the new Generation Rent survey, 29 per cent of Canadians have either given up on the homeownership dream or resigned themselves to being “forever renters”.

Shortly after the Bank of Canada’s most recent rate hike in June, financial research firm Finder asked more than 1,200 Canadians about their home-buying intentions.

Turns out one in 10 Canadians are still optimistic about becoming a first-time home buyer within the next 5 years, but almost a third (29 per cent) said that “renting forever” was a far more realistic option.

The survey data shows 16 per cent of Canadians – representing more than 5 million adults– said they were no longer interested in homeownership in 2022.

Another 13 per cent (almost 4 million) said they expected to rent for the rest of their lives.

In a similar 2019 Finder survey, 1 in 10 Canadians reported no interest in owning a home, so the number of Canadians joining the ranks of Generation Rent rose by 60 per cent in just two years, noted Romana King, senior finance editor with fintech comparison platform Finder.com.

“Buying a home is a significant decision that requires a large emotional and financial commitment,” said King. “For many, the erosion of housing affordability combined with rising mortgage costs, means the barriers to homeownership appear almost insurmountable – and it’s turning a generation of Canadians into forever renters.”

B.C. residents were the most likely to say they would likely rent rather than buy a home, at 29 per cent.

Quebec residents were the second-least interested in homeownership, with nearly a quarter (23 per cent) declaring no property ownership desire. A

Alberta and Ontario residents also showed their disinterest with 17 per cent declaring no property ownership desire and a plan to rent forever.

The homeownership rate in Canada is 68.5 per cent, as of 2018, according to Statistics Canada.

While this is a relatively high rate, Canada lags similar countries, as measured through the Organization for Economic Cooperation and Development (OECD). Based on data from the OECD, Canada’s homeownership rate is in the bottom third when compared to 38 other European, Eastern European and Scandinavian countries.