麻豆传媒映画medical device maker Neovasc has been acquired by Shockwave Medical (NASDAQ: SWAV) in the U.S. for $135 million.

Shockwave paid US$27 per share for Neovasc, for a total of US$100 ($135 million), and will pay Neovasc shareholders another $63 million, should certain regulatory milestones be reached.

Neovasc is a medical device company specializing in heart devices. Shockwave also specializes in heart devices.

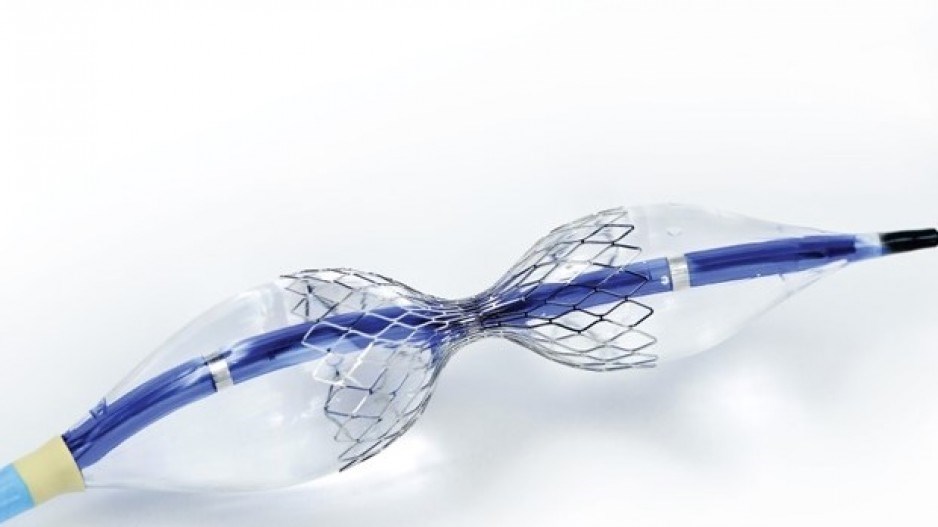

Neovasc developed the Neovasc Reducer System, described by Shockwave as “a first-of-its-kind technology to address refractory angina.” The Reducer has been available in Europe since 2015 but is still undergoing clinical investigation in the U.S.

Neovasc also developed the “tiara” for treating a heart condition known as severe mitral valve regurgitation -- a device that sparked a patent infringement case.

Neovasc was formed in 2002 and grew through a number of acquisitions. In 2016, the company became the subject of a over its tiara device. Edwards Lifesciences CardiAQ LLC sued for breach of intellectual rights and breach of contract.

A court found in favour of CardiAQ and Neovasc was ordered to pay the company US$70 million. Despite the court’s findings of patent infringement, Neovasc was allowed to continue to develop the tiara heart valve. However, in 2022, Neovasc halted all development of the tiara device.

In November, the Centers for Medicare and Medicaid Services determined that U.S. hospitals could be reimbursed for using the Neovasc Reducer in heart implants. In January, the company announced Shockwave had made an offer to buy the company, which shareholders approved last month.

Shockwave’s acquisition of Neovasc officially closed today. Neovasc has been delisted from the Toronto stock exchange and Nasdaq.