Artemis Gold (TSXV:ARTG) has added $54 million to the Blackwater gold mine budget so that certain aspects of the phase 1 development can be optimized. The gold streaming agreement with Wheaton Precious Metals has been amended to provide the additional funding.

The extra funds will be used to purchase additional structural steel and increase conveyor belt widths in the crushing circuit.

Variable-speed drives have been added to the ball mill, and electrical components have been upgraded to facilitate the second phase requirements and to create back-up power sources.

The oxygen plant has been upsized to increase down-shaft-sparging of oxygen into the pre-leach and carbon-in-leach trains. The CIL layout has been optimized so that expansion into phase 2 can be done without interrupting processing.

Finally, the detoxification process will be fully converted to remove the need for tanker-supplied liquid sulphur dioxide.

The cost of these additions, together with over-budget expenditures on permitting costs and additional bonding costs connected to those permits, will require total additional funding of approximately $50 million.

The capital requirement to the first gold pour is now estimated to range between $730 million and $750 million. Artemis says the project is now 20% complete.

The company intends to commission an optimization engineering study to formally outline the benefits of the installation of the additional equipment outlined above and to confirm the benefits of advancing the phase 2 expansion earlier than contemplated in the September 2021 feasibility study.

The results of this study are expected to be released in the fourth quarter of 2023.

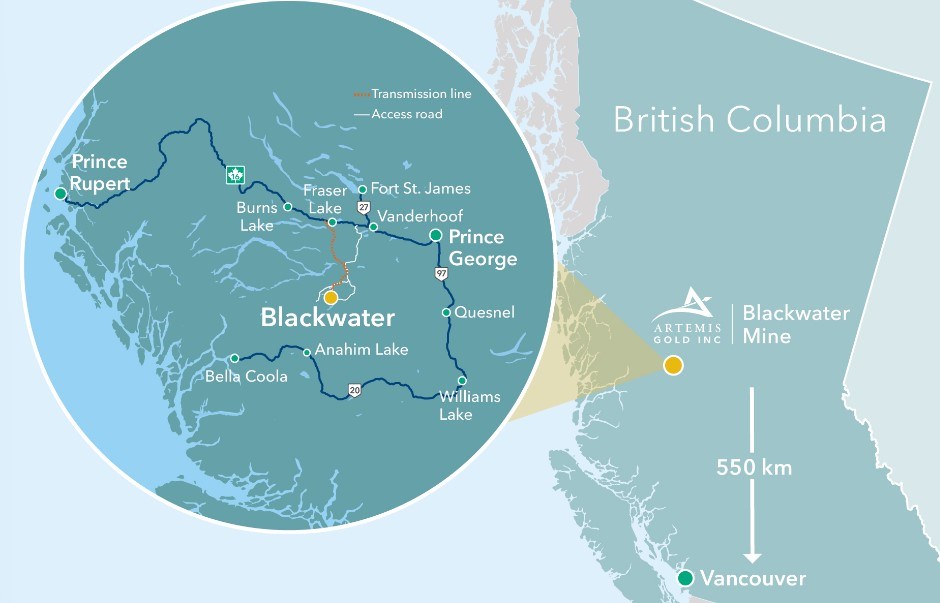

The 100%-owned Blackwater mine is 160 km southwest of Prince George, B.C. With a price tag of approximately $1.4 billion over three phases, Blackwater is one of the largest capital investments in the region over the last 10 years. The first gold pour is planned for the second half of 2024.