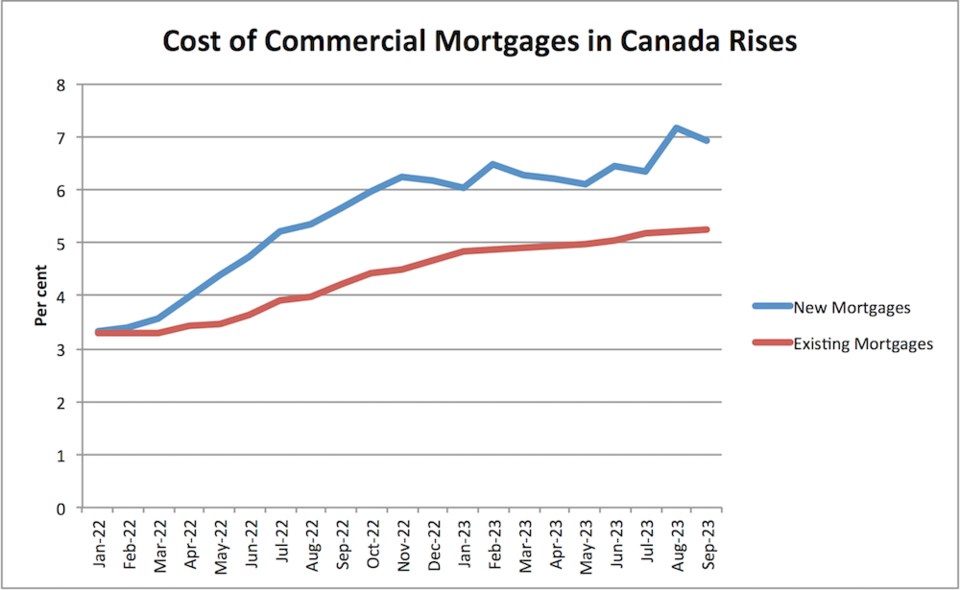

Two years of rising interest rates may have come to a stop – or they may not, given the mixed signals in the latest Bank of Canada statements and communications from central banks elsewhere.

The uncertainties have put a halt to investment, borrowing and ultimately financing, with lenders taking a closer look at every deal that comes forward to ensure the projects seeking financing measure up.

“There’s pressure all the way around, so we’re really going after quality,” David Gilbertson, regional director, commercial mortgages, with RBC Royal Bank said during a panel discussion on the current lending environment organized by commercial real estate association NAIOP in Â鶹´«Ã½Ó³»on Nov. 16. “We’re not really changing our underwriting criteria very much, we’re just really scrutinizing each tenant, we’re scrutinizing tenant tenure, we’re looking for operators that can diversify.”

Borrowers are being stress-tested with rates of 7 and 8 per cent, said Matthew Middleton, director, real estate debt, with Nicola Wealth Real Estate in Vancouver.

He told the meeting that two years ago a borrower approaching 12 lenders would receive 12 quotes in a fairly close range, underscoring the consensus in the market with where things stood post-pandemic.

But the sharp rise in interest rates since March 2022 compounded the effects of inflation to create a much more uncertain environment. Today, Middleton said, a borrower approaching 20 lenders might land six quotes at a greater range of pricing.

But even with a fully tenanted building, the lack of recent transactions – another function of the lack of certainty in the market – makes it tough for lenders to understand the values of the assets they’re being asked to lend against.

“Once you have certainty on your cap-ex, then you’ll have more transactions, lenders will be more comfortable underwriting value,” Middleton said. “That, as well, will open up and lead to more accommodative financing terms.”

Middleton expects lenders in Canada to put a greater emphasis on cash flow, similar to what’s happened in he U.S, particularly in the wake of the collapse of several regional banks, most notably Silicon Valley Bank and First Republic Bank, earlier this year.

The drama also saw lenders demand deposits from borrowers up front, a bid to bolster their own reserves in response to closer federal scrutiny. (Canada’s banks, by contrast, are well capitalized, having strong deposit-funding practices in contrast to many of the smaller U.S. banks.)

“For any type of development financing, in order to actually procure that financing, you needed to provide deposits from 10 to 20 per cent of the loan amount,” Middleton explained. “You tap on a 10 per cent to 20 per cent deposit, your effective leverage is 40 per cent. … It becomes really challenging for that to pencil out.”

The close scrutiny lenders such as RBC are paying to deals in Canada nevertheless mean borrowers should have a good roster of financing sources at the ready. The good news is that many lenders are willing to place capital at the right terms.

While industrial and multifamily assets continue to see cap rates below borrowing costs because of supply shortages, making them attractive to more traditional lenders, it’s the opposite case with office space.

“If your best interest rate you can possibly find right now is 5.5 per cent, there’s still probably a point premium added on the cap rate as a buffer there,” said Nate Larsen, senior director, mortgage origination at Canada ICI Capital, while noting, “There will be appetite from non-bank and alternative lenders.”

Gagan Lalli, vice-president, real estate finance, at CMLS Financial, said second-tier lenders are actually growing their portfolios.

“We have seen a big inflow of people that are looking to put out that money because of returns,” he said.

Middleton also sees a desire to place capital as the market stabilizes.

“Looking at our enterprise, I can attest there’s a ton of investor demand for private assets. Investors want to put money into private debt. They want to put money into private mortgages,” he said. “In the last 15 years, when you have been able to get equity-like returns with a debt issue? … Rates have been zero. Because we have these attractive returns, I think we have a lot of dry powder in the background.”

Right now, the money is flowing into sectors where prospects are strong but there’s less competition.

“If you’re looking to place capital and you’re not putting it into office, then where else are you putting it? Multifamily rental is dominated by CMHC; it’s ultracompetitive. Industrial, no one wants to do it, it’s also competitive,” he said. “I think it goes into retail, I think it goes into self-storage, it goes into seniors [housing].”