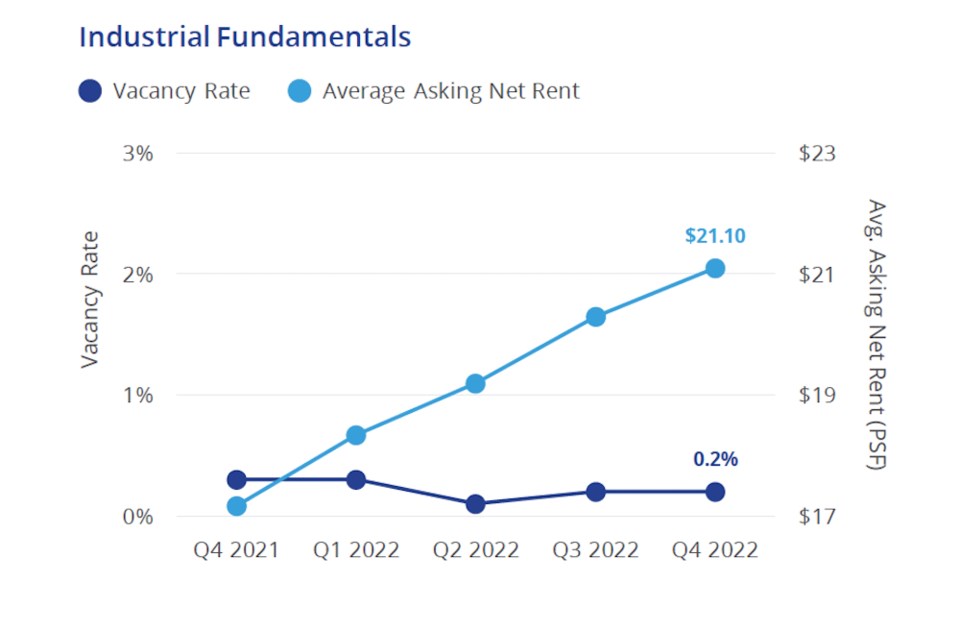

Metro Vancouver’s industrial vacancy rate ended 2022 unchanged at 0.2 per cent, Colliers International reported this week, despite record volumes of new construction.

Close to 4.4 million square feet were added to the market last year, and a further 6.9 million square feet are under construction.

But most of the space is spoken for, meaning it would take another 6 million square feet delivered to the market to push vacancies above 3 per cent and create a more attractive leasing environment.

“We have had new space brought to market, but it’s not fast enough to meet demand, and we’re in a historically high construction period for industrial,” said Susan Thompson, associate director, research, with Colliers in Vancouver.

Approximately a quarter of the space under construction is smaller, strata-titled units, while 75 per cent is for larger tenants requiring 100,000 square feet and up. But most of it is spoken for, with 60% of the available listings for spaces of less than 20,000 square feet.

This leaves few options for companies looking to expand or locate in the Lower Mainland.

“Most of the time they’re looking at buildings that are being planned for construction, and they’re potentially having to look 12 to 18 months out to get a space that’s appropriate,” Thompson said.

Some relief has come from the fact that demand from e-commerce companies has tapered off in the latter half of 2022 from the peaks seen in 2021, creating more options for fulfilment and distribution tenants. But with additional space hard to come by, she says the outlook for the second half of 2023, when the economy is expected to pick up, is troubling.

While the overall availability rate eased over the past quarter from 0.7 per cent to 1 per cent, it still remains extremely low. Tenants simply don’t have enough options.

“We’re going to continue see record-low vacancy, and we will likely see those rental rates continue to increase,” she said. “We’re the first market in Canada to see average net rents for industrial exceed $20, and they continue to rise. So the question now is, how high can they go?”

The average asking rent for industrial space in Metro Â鶹´«Ã½Ó³»is currently $21.10 per square foot, up from $20.44 at the end of September.

The only other market that comes close is Victoria, where industrial space averages $18.05 a square foot. A smaller market, it has even less space available to tenants than Vancouver. Vacancies average 0.1 per cent.

The third most expensive industrial market in Canada is Toronto, at $17.09 per square foot. While vacancies are running 0.3 per cent, the scale of the market translates into 2.3 million square feet of opportunities – a volume land-constrained Â鶹´«Ã½Ó³»can only dream of.