Shifting office space requirements in the hybrid work environment that continued as workers returned to the office following the lifting of public health restrictions has left many cities in Western Canada facing a glut of office space.

Many downtowns are facing a decade-long surplus as space that was under construction when the pandemic hit was delivered to a significantly different market.

CBRE Ltd. in Winnipeg, for instance, anticipates a decade-long overhang once Wawanesa consolidates its offices in a new office tower at True North Square in January. Colliers reports elevated office vacancies in Saskatoon, primarily in older space in need of upgrades.

A report from Cushman & Wakefield earlier this year estimated that the U.S. office inventory will approach 5.7 billion square feet by 2030. But the persistence of hybrid work arrangements mean office requirements will total just 4.6 billion square feet, a difference of about 1.1 billion square feet that signals a period of prolonged vacancies in many markets.

According to Cushman & Wakefield, a quarter of U.S. office space will need to be reimagined in order to compete in the more competitive market that’s taking shape.

A similar scenario is possible in Canada, where CBRE reports that more than 42 per cent of the office market is lower-tier space where vacancies at the national level averaged 19 per cent at the end of the second quarter. Class B space in the country’s downtowns is especially struggling, with vacancies averaging 23.3 per cent.

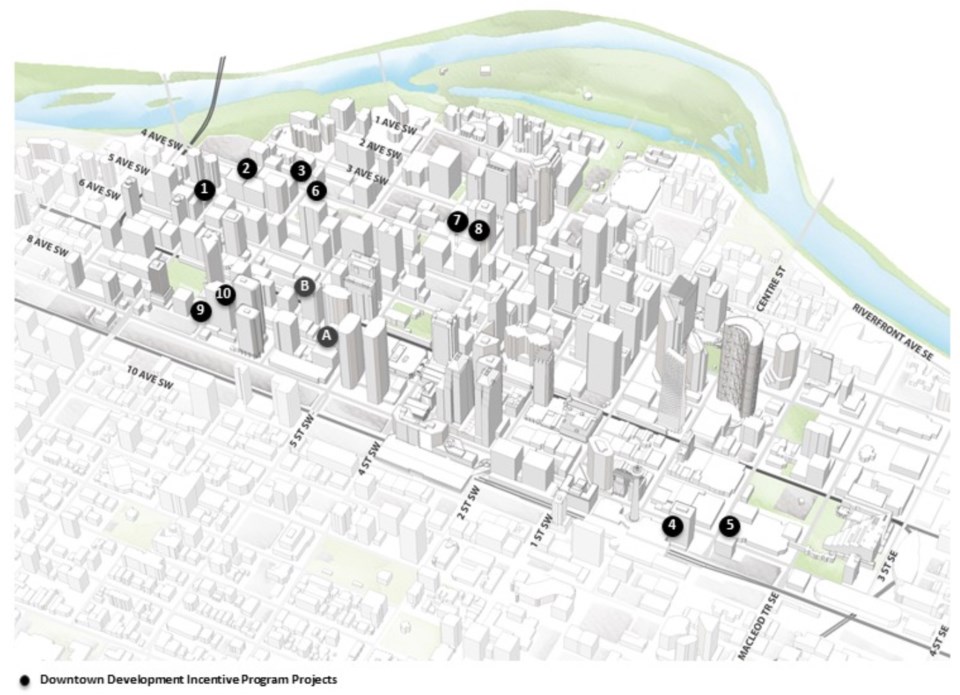

One answer, according to brokers in Saskatoon and Winnipeg, could be a program similar to what exists in Calgary, which launched a Downtown Development Incentive Program in 2021 with the aim of removing 6 million square feet of office space from the market by 2031.

Calgary continued to boast the highest downtown office vacancy rate in the country at 31.5 per cent at the end of the second quarter, according to CBRE, but the rate is down from 32.7 per cent two years earlier as landlords signed onto the new program and began removing space from the market.

A new report from Avison Young pegs the current downtown office vacancy rate at 27.3 per cent, but says without the downtown incentive program, the rate would be two percentage points higher.

“The biggest impact is in the C-class space, with a 7.6 per cent decrease in vacancy. Class B properties experienced a 6.2 per cent drop,” the report says.

Class B space is proving the toughest space to fill, however, in part because there’s simply so much. The total inventory is 9.3 million square feet and 39.4 per cent is vacant. A much smaller volume of Class C space, approximately 1.8 million square feet, means less needs to be filled to achieve a reduction of equal proportion. This has helped push vacancies down to 25.9 per cent.

The particular challenges facing Class B space underscore the persistent challenges Calgary and other markets will continue to face as markets adjust to market demands.

Greg Kwong, managing director with CBRE in Calgary, says even if the city’s incentive program succeeds in removing 6 million square feet of older space from the market, it would leave a further 5.2 million square feet needing to be filled. That amounts to more than 12 per cent of the current downtown inventory.