The majority B.C. homeowners-investors might be getting a bad rap, according to the chief economist of the B.C. Real Estate Association (BCREA).

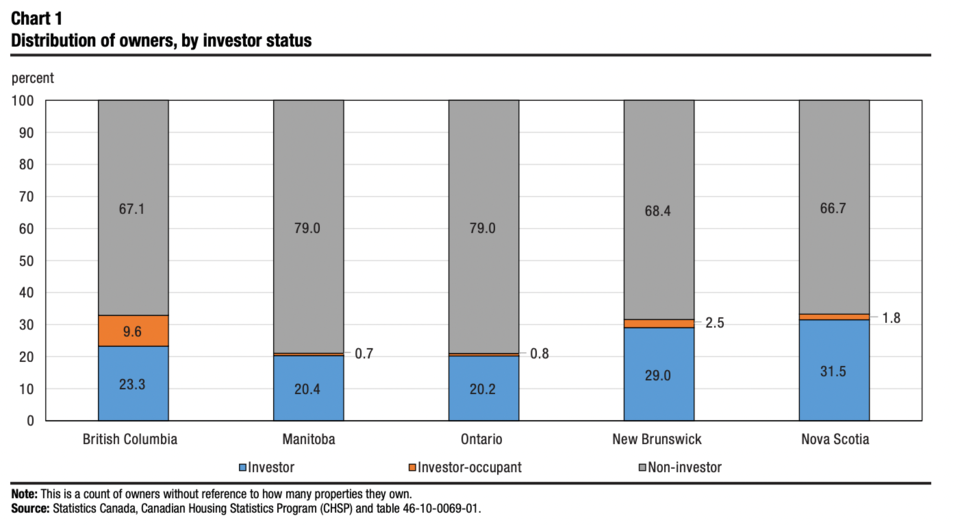

Statistics Canada released data last week revealing 23.3 per cent of B.C. homeowners are also investors in the market. The ¬ť∂Ļīę√Ĺ”≥Ľ≠census metropolitan area (CMA) had an overall investment rate in condominiums and houses of 21.3 per cent.

“Investors often get kind of painted as speculators who are out to buy up housing and do nothing with it, or flippers or any other kind of pejorative terms that we add to investors. But what this data shows, and what's good to understand, is that they've really invested a lot in primary rental in Canada,” said Brendon Ogmundson. “A lot of the rental units that are being provided are smaller investors who own one unit and are renting it out.”

Statistics Canada defines an investor as an “owner who owns at least one residential property that is not used as their primary place of residence.”

In B.C., 73 per cent of properties with multiple dwellings were owner-occupied investment properties. Investor-occupants are more common in the province, making up 9.6 per cent of owners.

This is due to a higher proportion of properties with multiple residential units – 11.7 per cent – such as laneway units or basement suites, according Statistics Canada. The national statistics agency said these types of units are more likely to be owner-occupied.

“So many owners in B.C. have chosen to also be landlords by renting out their basement suites or laneway houses and it's way, way different than any other province in this dataset,” Ogmundson said.

The region of Greater ¬ť∂Ļīę√Ĺ”≥Ľ≠A or Electoral Area A, which includes the University Endowment Lands, Barnston Island, Howe Sound communities, Indian Arm and Pitt Lake communities, had a higher proportion of houses and condominium apartments used as an investment at 42.1 per cent compared with the rest of the region.

The City of ¬ť∂Ļīę√Ĺ”≥Ľ≠had a lower proportion at 32.5 per cent.

This difference is attributed to students attending the University of British Columbia, who are more likely to be renters or live in a second property owned by a family member, according to Statistics Canada.

The proportion of condominium apartments owned for investment purposes by non-resident investors was the highest in B.C. among the provinces – seven per cent.

The rate of condominium apartments used as investment was lower in the ¬ť∂Ļīę√Ĺ”≥Ľ≠CMA (34 per cent) than the rest of the province.

Across B.C., non-residents and out-of-province investors owned 43,890 houses used as an investment. This number was typically higher in areas near the Alberta border.

Out-of-province investors owned 1.6 per cent of homes in B.C., while in-province investors accounted for 9.8 per cent of all investors.