Â鶹´«Ã½Ó³»continues to have the least affordable housing in the country, RBC Economics reported on June 23.

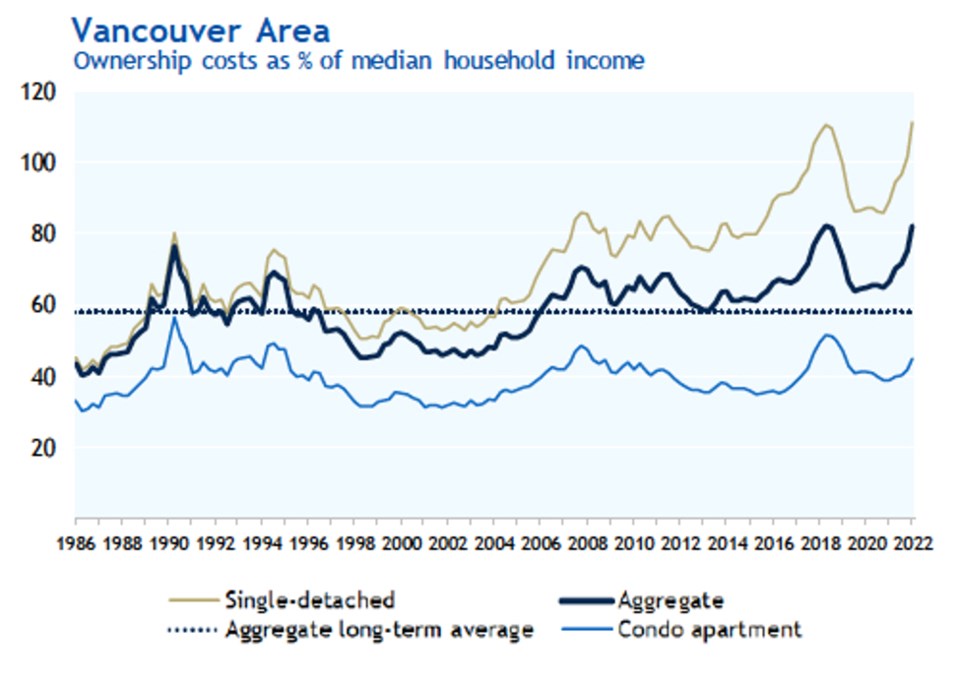

During the first quarter, the price of the average residence in Â鶹´«Ã½Ó³»would devour 82 per cent of median household income – the first time the index has been this high since the first quarter of 2019.

“The bad news is that it will likely worsen,” RBC chief economist Robert Hogue wrote, noting the impact of higher interest rates, which have increased six-fold since March and will likely leap again on July 13. “Any further rate hikes are poised to hit local buyers disproportionately and the outlook for the market has already shifted. Resale activity has fallen by a third this spring and we see the weakening trend persisting in the months ahead.”

A standard definition of affordable housing is anything requiring less than a third of household income.

RBC doesn’t offer any solutions to improve affordability. Rather, it says affordability will follow as wages increase and housing prices drop. It forecasts a 13 per cent drop in residential prices this year for BC.

Some say the decline has already started, with the Real Estate Board of Greater Â鶹´«Ã½Ó³»reporting that the benchmark price for residential properties fell 0.3 per cent in May to $1,261,100.

According to the development sector, more homes are the way forward. By providing a greater selection of units at a greater range of price points, prospective buyers will have more options and upward price pressure will be diffused.

“Part of the essence of increasing supply is not just literally creating more single-family homes or more condos, it’s to create more supply to give citizens a better opportunity to get into housing that fits and suits their needs,” said Shane Styles, president of Epic Real Estate Solutions in Kelowna. “Some of those needs are financial, some of them are geographic. Some are family-related. … Affordability isn’t just what my rent is every month or my mortgage. It’s also how much do I have to pay in gas to get to my job, or take my kids to their activities.”

According to a report from the Canada Mortgage and Housing Corp. last week, 570,000 new homes are required in B.C. by 2030 to restore any semblance of affordability – which CMHC defines as housing requiring 44 per cent of disposable income. Currently, residents of BC require 58.3 per cent of their income to purchase a home, based on the average price of homes listed and sold through the MLS platform.

“How will supply improve affordability? More housing units created in the housing market will create opportunities for households to move into housing that responds to their demands,” CMHC stated. “In addition, this ‘filtering process’ likely frees up housing to improve housing affordability over time.”

However, CHMC also urged a separation of home ownership from the rental system “because increasing the supply of rental units will play a critical role in achieving affordability over the long term.”

But the two are linked. High home ownership costs tend to keep people renting for longer, and the high cost of housing means a greater supply of rental housing is needed. But even it’s not coming fast enough.

“Housing affordability is a rising concern for all buyers in the market, particularly given the inability of all levels of government to accelerate the construction of new rental supply,” said Michael Ferreira, principal of Zonda Urban, of the Â鶹´«Ã½Ó³»market. “There are just 21 new purpose-built rental projects with just over 1,600 units scheduled to complete by the end of this year. This is a fraction of what’s needed to meet existing demand, let alone the new demand created by significantly higher immigration targets over the next few years.”

The result is upward pressure on rents across the market, because supply can’t keep pace with demand.

In some markets, Ferreira said, monthly rents are pushing $6 a square foot – an unprecedented level for the region.