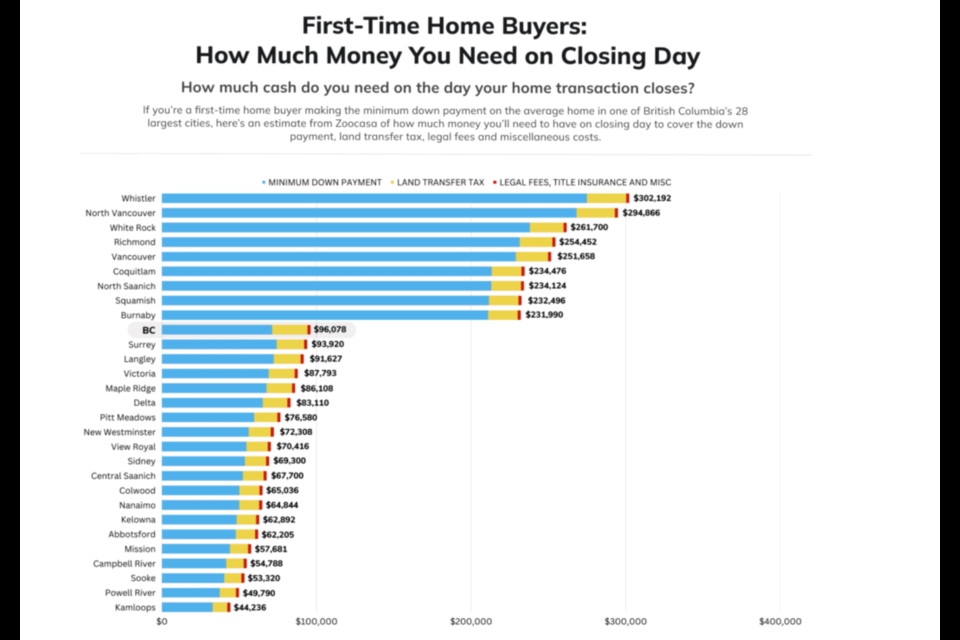

Whistler, North Â鶹´«Ã½Ó³»and White Rock have the highest closing costs on home purchases in B.C., according to new data from Zoocasa.

The data shows that cities with expensive home prices typically have higher down payments, resulting in elevated closing costs.

Coming in at the most expensive with an average home price of $1,373,600 as of March 2023, a buyer in Whistler can expect a closing cost of $302,192 with an approximate down payment of $274,720.

In North Vancouver, typical closing costs could fall around $294,866. White Rock is not far behind at $261,700, while Richmond and Â鶹´«Ã½Ó³»are fourth and fifth at $254,452 and $251,658, respectively.

Closing costs typically include the minimum down payment, land transfer tax, legal fees and title insurance. In some cases, a mortgage loan insurance premium is included but is not added to the final closing costs in this data set, according to Patti Cosgarea, senior manager of public relations and content marketing.

In a time where B.C. market conditions are tight, it is common to see a multiple offer situation on homes, said Cosgarea.

"Buyers really need to be prepared, especially in situations where they are entering multiple offer scenarios. People tend to stretch themselves in those moments when they really want to close on a house; they really want to secure it. So, it's really important to recognize just how much of the final cost really goes towards the closing costs," she said.

The average closing cost for all of B.C. is roughly $96,078, with Sooke, Powell River and Kamloops posting the lowest and most affordable closing costs in the province, the data shows.

Closing costs in Kamloops, the lowest of all B.C. communities, fall around $44,236, with Powell River at $49,790 and Sooke at $53,320.

In terms of home prices, there are only four B.C. communities with average housing prices below the national average of $686,371.

"We really want to empower buyers and sellers. And the more that they know, the better prepared they can be. It can be scary to see all of this and how expensive it can be to buy a home, but really, it helps our buyers prepare for today's market and what the circumstances are," Cosgarea said.

The data uses an average legal fee and title insurance fees of $2,000, but according to Cosgarea, this can vary.

"Oftentimes, what's good for buyers to know is that they can get multiple quotes from various legal offices, which is really important. But they also might not really know what they're going to be paying in legal fees until closer to their closing date," she said.