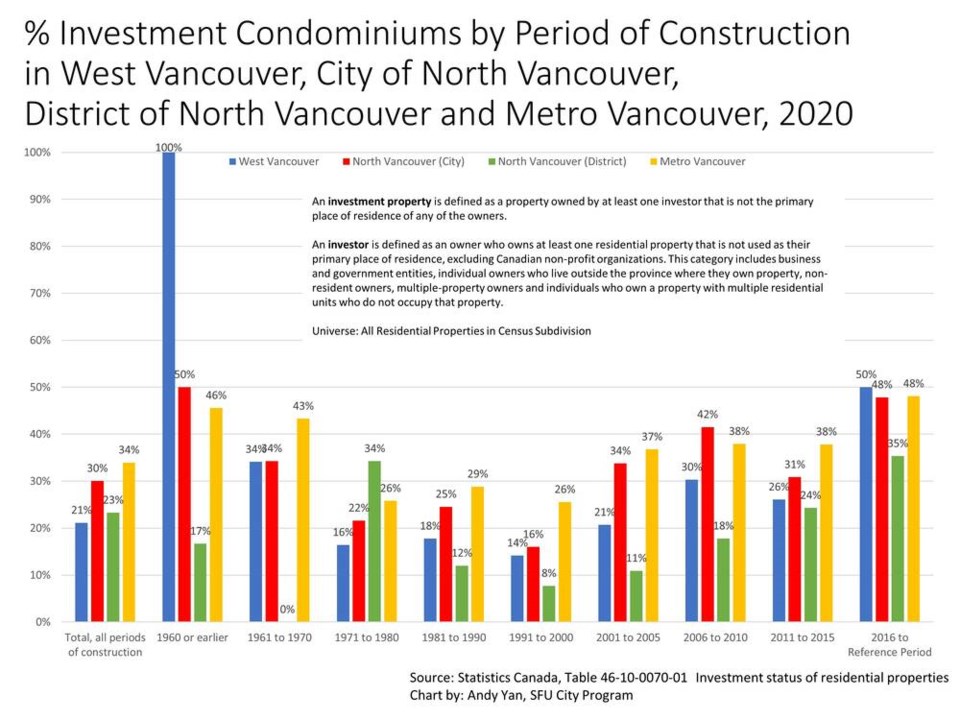

About 30 per cent of condominiums in the City of North Â鶹´«Ã½Ó³»are owned by investors who don’t live there, according to recent statistics on investment properties released by Statistics Canada. And among condos built between 2016 and 2020, that percentage is significantly higher, with 48 per cent of condos built in North Â鶹´«Ã½Ó³»and 50 per cent of condos built in West Â鶹´«Ã½Ó³»owned by investors.

The statistics come from a recent analysis of data on investment properties by Andy Yan, adjunct professor of Urban Studies at Simon Fraser University and director of SFU’s City Program.

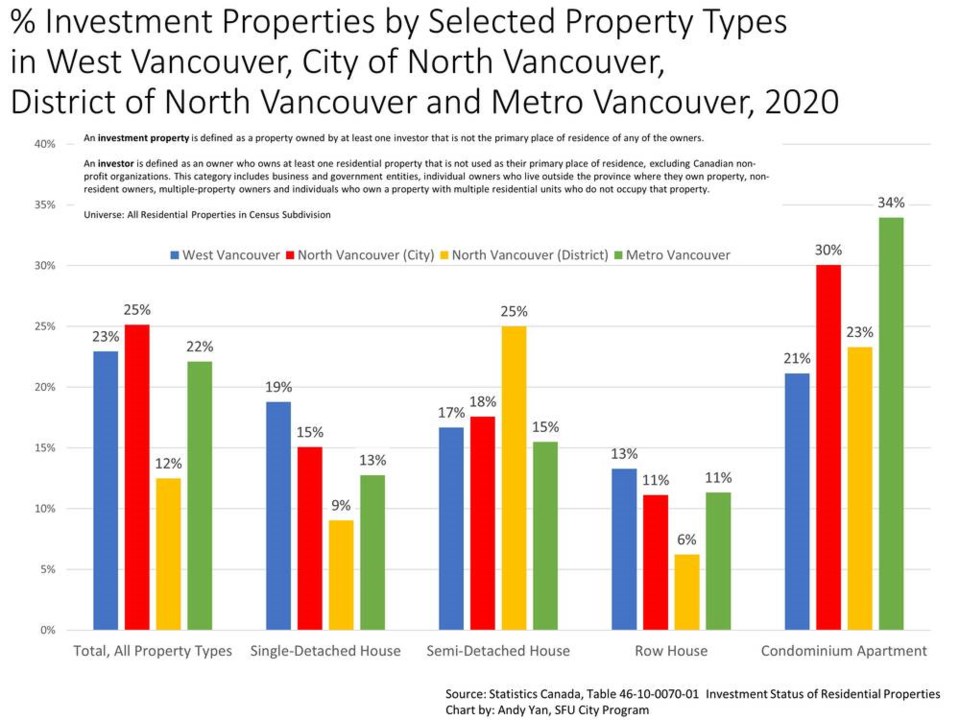

Overall, the North Shore’s proportion of properties owned by investors in 2020 was comparable to the rest of Metro Vancouver, according to Yan’s analysis.

City has highest percentage of investor-owned condos

About 25 per cent of total properties in the City of North Â鶹´«Ã½Ó³»and 23 per cent of properties in the District of West Â鶹´«Ã½Ó³»are investor owned, compared to 22 per cent in Metro Â鶹´«Ã½Ó³»overall. The District of North Â鶹´«Ã½Ó³»had the lowest percentage of properties owned by investors on the North Shore at 12 per cent.

Those figures varied by type of housing. Condos were most likely to be owned by investors throughout the region with 34 per cent owned by people who didn’t live in them across Metro Vancouver. On the North Shore, 30 per cent of condos in the City of North Â鶹´«Ã½Ó³»are investor owned while 23 per cent in the District of North Â鶹´«Ã½Ó³»and 21 per cent are owned by investors in West Vancouver.

Yet far more condos built in the past 15 years were likely to be owned by investors. Half of the condos built in West Â鶹´«Ã½Ó³»between 2016 and 2020 were investor owned, while 48 per cent of those built in the City of North Â鶹´«Ã½Ó³»were investor owned. In contrast, among condos built between 1991 and 2000, less than half that number were investor owned.

“It gives you a sense of what’s driving condo building,” said Yan.

Condos on the North Shore built before 1980 are also more likely to be investor owned. Yan said it’s possible that’s because there weren’t many condos built then. “Condominiums really were not that popular until the 1980s,” he said.

19 per cent of single-family homes investor owned in West Van

West Â鶹´«Ã½Ó³»also had a much higher proportion of single-family homes owned by people who don’t live there – 19 per cent – than Metro Â鶹´«Ã½Ó³»overall, where 13 per cent of detached homes were owned by investors. In the City of North Vancouver, 15 per cent of detached homes were owned by investors, while that number was just nine per cent of single-family homes in the District of North Vancouver.

One thing the statistics don’t reveal is how many of those investor owned properties are being rented out to long-term tenants, how many are being left empty or used occasionally by owners and how many are being used as short-term rentals.

Those answers are key to housing polices ranging from the speculation and vacancy tax to new laws allowing rentals in all strata apartment buildings, said Yan.

Investor-owned condos can provide an important part of the rental market, but those apartments also tend to be more expensive and more precarious than purpose-built rentals, said Yan.

Investors can also over-heat the market and out-compete renters hoping to move into the housing market, said Yan.

According to Statistics Canada, the proportion of investors among owners varied from 20.2 per cent in Ontario to 31.5 per cent in Nova Scotia.

Just under one in five properties was used as an investment in British Columbia, Manitoba, Ontario, New Brunswick and Nova Scotia combined.

Condominium apartments were used as an investment more often than houses. Ontario topped the list with the highest rate of condominium apartments used as an investment, at just under 42 per cent.

“Just be glad you don’t live in London, Ontario,” said Yan – 87 per cent of condos there are owned by investors.

Increase in investor purchases during first half of 2021

According to a report on investor owners by Statistics Canada, the Bank of Canada found an increase in the proportion of purchases by investors in Canada in the first half of 2021.

The Canada Mortgage and Housing Corporation also surveyed investor owners.

They found that 48.4 per cent of investors in 2015 stated that their secondary unit was rented out, while 42 per cent stated that they or a family member were using the unit.

In general, studies found that an increase in the percentage of homes purchased by investors in a particular area led to higher prices in that market.

Yan noted the data that went into the Statistics Canada report all came from the period before the pandemic, and the real estate boom and trends of moving away from urban cores that happened in 2020 and 2021 could have changed patterns of investor ownership.