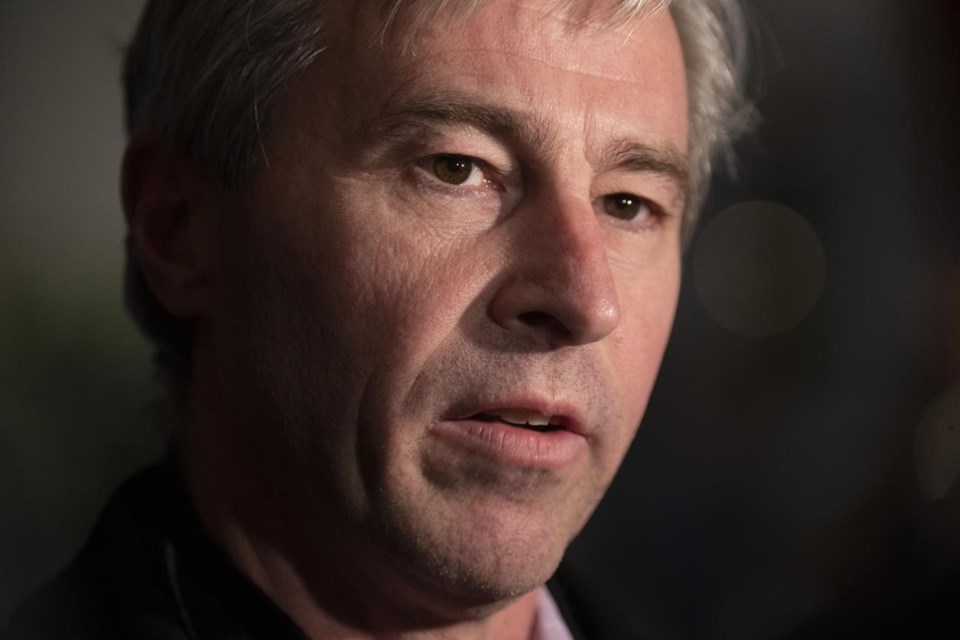

HALIFAX — Nova Scotia will remove the provincial portion of the harmonized sales tax from the construction of new rental apartment buildings, Premier Tim Houston said Thursday.

Houston said his province plans to mirror a move announced last week by the federal government, which said it would suspend GST on rental housing starts to lower the cost of labour and materials for homebuilders.

“The housing issues (shortages) are significant for sure,” the premier said. “There won’t be any one single solution that gets us through this. The federal government has started with this HST removal and we are going to do it as well.”

Nova Scotia's 15-per-cent harmonized sales tax combines the federal GST and the provincial sales tax; the provincial portion is 10 per cent. Houston said his government will remove the tax for two years and then reassess the effects on the market.

“There will be a lot of other initiatives that we will put toward the overall solution, but that’s where they (Ottawa) are starting and we will start there too,” he said.

The premier estimated that the move would cost the government between $80 million and $100 million a year.

Nova Scotia’s opposition parties said they were on board with the premier’s decision.

Liberal Kelly Regan called it a “first step,” adding that the government needs to come out with a plan to deal with housing shortages — which it promised in the spring.

“We’d like to know what their plan is for student housing — again it’s overdue as well,” Regan said.

NDP Leader Claudia Chender said any idea that could incentivize construction is positive, but she said it should come with strings. The government should tie the tax suspension to timely construction starts, and ensure that potential savings are passed on to renters instead of “lining the pockets of developers.”Â

“Those are the things that will move the needle,” Chender said.

In Ottawa Thursday, Finance Minister Chrystia Freeland introduced legislation that would remove GST charges from new rental developments. Under the federal proposal, new projects for which construction started on or after Sept. 14 and that launch until the end of 2030 are eligible for the full rebate. The projects must be finished by the end of 2035.

This report by The Canadian Press was first published Sept. 21, 2023.

The Canadian Press