Property taxes will go up again this year in Vancouver.

But some property owners may not see a city staff-proposed tax hike of 9.7 per cent, according to a that goes before council Feb. 28.

“While the council-directed property tax increase applies to the overall tax levy, the extent of change, year over year, in an individual property’s tax is determined primarily by how that property’s assessed value has changed relative to the average change within its property class,” the report said.

“Properties with a higher increase in value relative to the average change of their class could experience a much higher increase in property tax beyond the council-directed increase, while properties with a lower increase in value could experience no change or a reduction in property tax.”

The report didn’t provide an estimate on how many property owners could face a higher increase versus a lower increase, or a reduction in what a person will pay in 2023. But it’s a fact that a person who owns a single-family home will pay more in tax than an owner of a strata condominium.

Why?

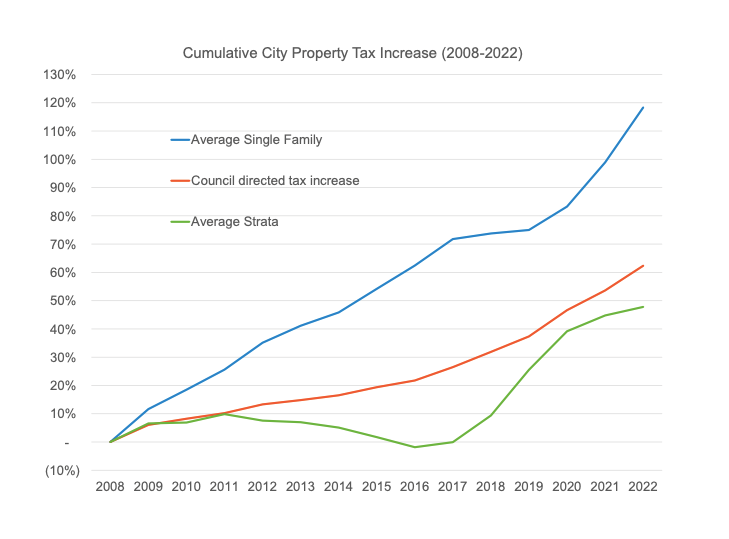

Largely because the value of single-family homes increased at a much faster pace than that of strata condominiums during most of the past decade. That’s why strata owners saw a much lower tax increase or, at times, a reduction in property tax.

In 2022, approximately 40 per cent of residential properties in Â鶹´«Ã½Ó³»were single-family homes. Another 56 per cent were strata units and the remaining four per cent were other forms of housing.

City statistics show strata owners paid an average of $1,306 in property tax between 2018 and 2022. Over the same period, a single-family homeowner paid an average of $3,308.

A chart attached to the city report (see below) shows taxes to condos plateaued in 2011 and only picked up again at the tail end of 2018, while single-family homes saw a steady and significant increase from 2008 to present.

Â鶹´«Ã½Ó³»Police Department

The proposed 9.7 per cent hike this year is being driven by 2.7 per cent for the Â鶹´«Ã½Ó³»Police Department, one per cent for infrastructure renewal, one per cent for “reserve replenishment for financial sustainability” and five per cent for funding across city services “as well as risks around uncertain costs across the city, inclusive of VPD.”

Last November, the majority of city council approved $16 million to help fund ABC Vancouver's campaign promise to hire 100 new officers and 100 mental health nurses. Council recently agreed to have $2.8 million of the $16 million be transferred to Â鶹´«Ã½Ó³»Coastal Health Authority to hire 58 mental health workers.

If council approves the 9.7 per cent tax hike, the owner of a home valued at $1.9 million will pay roughly $3,347 this year, an increase of $296 from last year. When you add $1,962 in utility fees — $834 for water, $751 for sewer and $377 for solid waste — that homeowner’s total bill is closer to $5,309.

The tab doesn’t include money that a homeowner may spend on licence and development fees, which increase five per cent, or pay fees for such services as pools and rinks, which are going up by three per cent.

Council will receive a staff presentation Feb. 28 and hear from speakers before reconvening March 7 for a possible decision on the operating budget, which is worth $1.9 billion. Last year’s hike was 5.7 per cent.

Council already approved in December the 2023 capital budget, including new multi-year capital budget allocations of $581 million and annual expenditure budget of $730 million.

Empty homes tax worth $44 million

Some other facts about the city’s $1.9-billion draft operating budget:

• About half the property tax paid by Â鶹´«Ã½Ó³»taxpayers goes toward funding city services, while the other half goes to provincial and regional taxing authorities to fund regional services, schools, transit and property assessment services.

• In 2023, the city’s empty homes tax will be included in the budget for the first time. Estimated at $44 million, it can only be used to fund new initiatives to support affordable housing and potential initiatives brought forward to council for approval.

• Overall, utility rates are expected to increase an average of 10 per cent annually through to 2027, driven primarily by forecasted increases in regional utility charges from Metro Â鶹´«Ã½Ó³»and increased investments in infrastructure renewal.

• The provincial government’s implementation of the additional school tax on high-valued residential properties generated $99 million in Â鶹´«Ã½Ó³»in 2022; it was $72 million in 2021, and represented approximately 45 per cent of the additional school tax revenue across B.C.

• In 2021, the city contributed approximately $116 million in the form of property tax exemptions and grants to health-care and educational institutions and to charitable and non-profit organizations.