Today, most currency is electronic, swirling over the internet from banks to businesses and even in and out of the Federal Reserve. But, of course, that hasn't always been the case.

Before the internet—before even the telegraph, before the idea of currency itself—various modes and technologies had to be invented in order for humankind to evolve methods of fair trade, compensation, and reimbursement.

Before modes of currency were developed, bartering was the most common means for acquaintances to exchange goods and services; it required that both involved parties come to an agreement as to the innate value of what was up for exchange.

compiled a history of how humans have exchanged money throughout history, from bank notes and wire transfers to blockchain technology and cryptocurrency.

The earliest humans likely traded directly, bartering freshly gathered or hunted food for help chopping wood or other desirable goods and services. In some civilizations, forms of currency included shells and stones—including the massive, collective rai stones of the island nation of Yap and the almost sacred regard held for cowrie shells in West Africa.

Coins came about as a way to carry precious metals in a standardized measure, and later simply common metals that were durable in the marketplace.

As societies evolved over time, financial technologies were developed to keep pace with not only growing populations but the advent of new and dynamic forms of business and commerce. Many such developments effectively began to replace the need for face-to-face financial transactions, instead using communications networks to move and transfer money with very little need for human intervention.

Global society continues to invent new means by which to handle its financial exchanges. In another 50 or 100 years, there may be new forms of currency transactions that we can't even imagine today.

Ipsumpix/Corbis via Getty Images

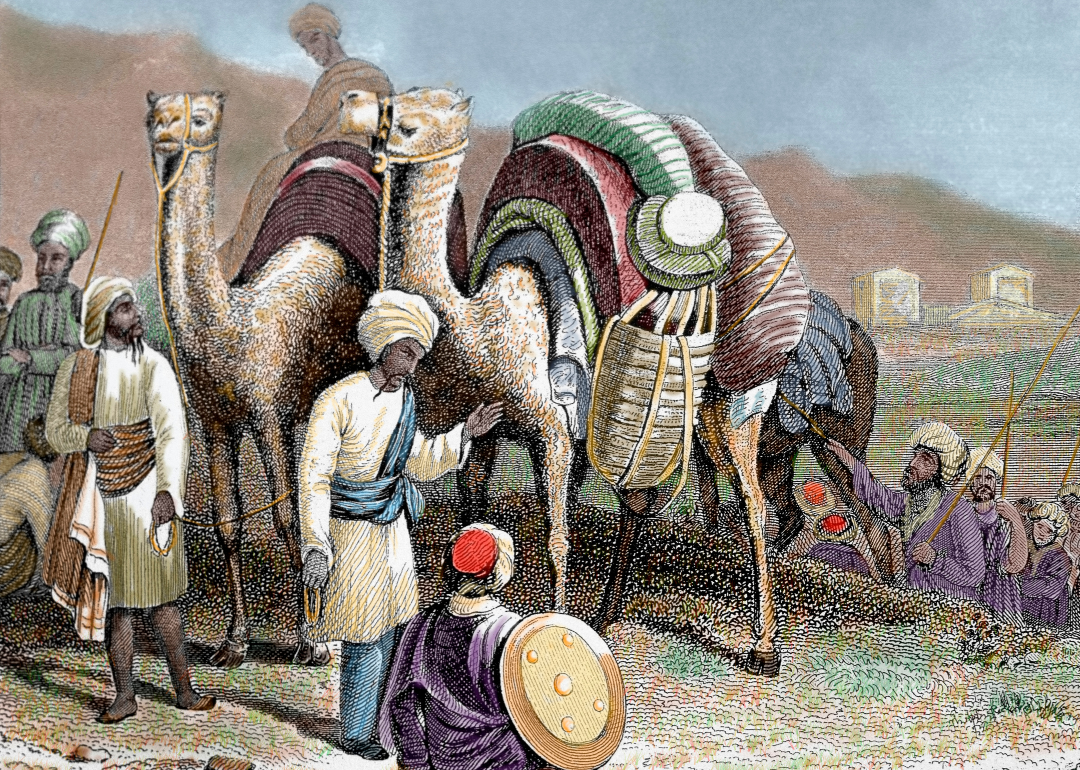

Early 800s: Muslim traders invent the sakk—an early form of the modern check

Today, paper checks are believed to be going the way of the dodo—the average person might have the same set for years or even longer, the need to use them diminishing by the year. But at one time, they were a cutting-edge development that also served an important purpose.

Muslim traders in the 9th century often had to travel over huge distances because communities and settlements were sparse. Instead of today's paper currency or plastic credit cards—both very light to carry—they were lugging around pounds and pounds of heavy metal coins.

To both simplify the buying and selling of goods and to reduce the undue burden on traders (and their modes of transit, e.g., camels), the sakk was born. A kind of formalized IOU, the sakk enabled merchants to receive compensation directly from a trader's bank account.

Universal History Archive/Universal Images Group via Getty Images

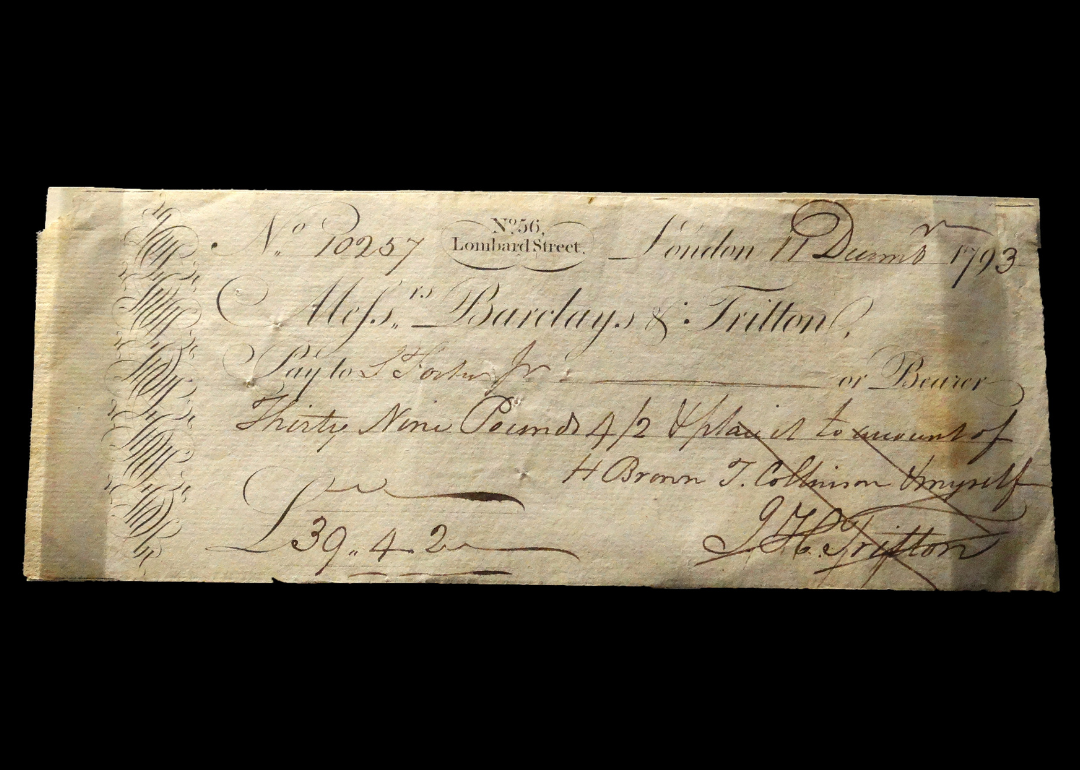

1864: First money orders are sent through the US Postal Service

A money order is a way to send money through the mail without having to send cash or a check. These have long been a way for people outside the traditional banking system to still send money for goods and services or to family in other areas.

Money order systems were attempted by private enterprises in Britain as early as 1792, ultimately unsuccessfully, but the money order as a formal system began in earnest in the United States in 1864 through the national postal system.

It was popular among Civil War soldiers as a means of sending money home. Shortly thereafter, in 1869, foreign currency orders were allowed through the system as well. Britain officially launched its own system—referred to as postal orders, rather than money orders—in 1881.

Today, many banks and credit unions offer fee-free accounts that even low-income people can afford to use. Even so, money orders remain a very popular way to send money with less risk of loss.

Bettmann // Getty Images

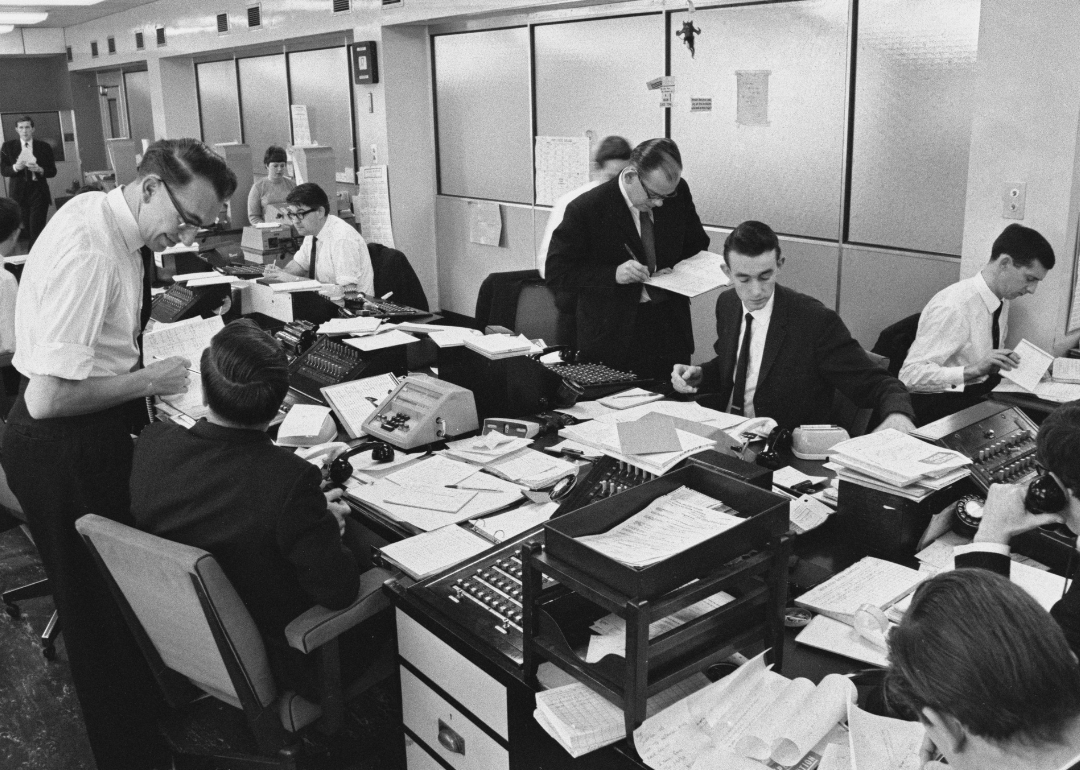

1871: Western Union launches wire transfer service

In 1851, Western Union was founded as the New York and Mississippi Valley Printing Telegraph Company. We don't see a lot of telegraphs today, but before the telephone, they were a critical way of delivering information quickly.

The Western Union company learned that they could piggyback their existing telegraph technology to do things such as transmit financial information and stock market numbers—and, yes, money.

Today, they operate a network of over 455,000 agents in 200 countries and territories and perform millions of money wire transfers each year both at bricks-and-mortar locations and via the internet.

Tereshchenko Dmitry // Shutterstock

1920s & 1930s: Money laundering gains prominence during US Prohibition

Money laundering is the process of taking money gained through illegal or illicit activities and, by filtering it through an intermediary, making it appear to have originated from legitimate sources. Contemporary society considers this to be criminal behavior, but hiding money is a crime of context, and context is never completely the same. In this regard, money laundering has a long history in human civilization.

Thousands of years ago in China, documents recorded how merchants laundered profits after local governments prohibited various forms of commerce. Since then, black market dealings, bribery, extortion (think here of "protection" money paid to organized crime syndicates), and myriad other illegal schemes gave rise to evermore devious methods of hiding and "cleaning" bad money.

When the 18th Amendment to the U.S. Constitution made the import, manufacturing, sale, and consumption of alcohol illegal in 1919, one result was an explosion of organized crime, with multiple outfits vying for the upper hand in the now-illicit world of drink. In order to hide their ill-gotten profits, crime syndicates would purchase legitimate businesses and then combine the financial streams of legal and illegal operations.

Such behaviour led to the famous conviction of crime lord Al Capone for tax evasion when prosecutors were able to prove that illegally obtained money went directly to him and was never declared to the government.

Evening Standard/Hulton Archive // Getty Images

1973: SWIFT is founded

The Society for Worldwide Bank Interface Financial Telecommunication is an organization that helps smooth international banking transfers. Every country has slightly different legal systems and banking regulations, and bringing them together to move money around the world is a huge, complicated project. SWIFT was founded by 239 banks across 15 countries, and today it is used in more than 200 nations.

As with wire transfers and other financial communications, SWIFT is a platform that provides a secure platform for financial transactions between international banking establishments. The international society has a domestic U.S. counterpart in the Automated Clearing House, which enables electronic fund transfers.

Jeff Overs/BBC News & Current Affairs via Getty Images

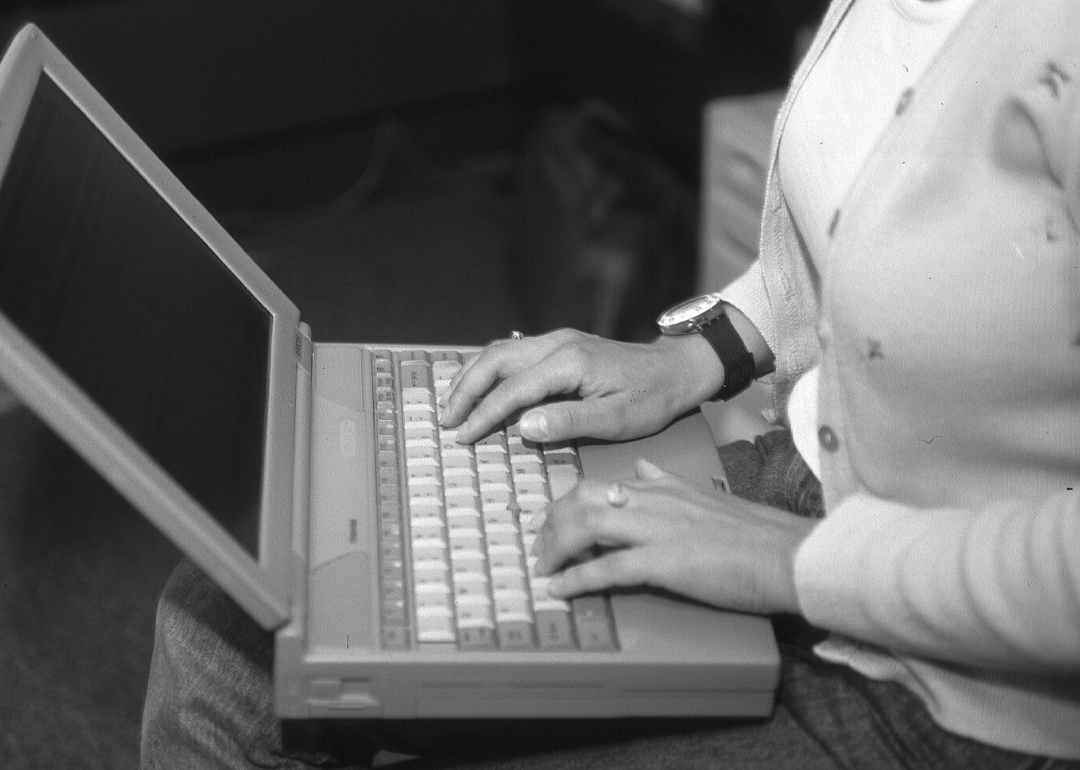

1990s: Internet payment systems are introduced into consumer markets

Credit cards changed how people felt about spending against their own earnings. When the Diners Club card first appeared in the 1950s, it was an aspiration concept; it sold the idea of luxury, of being able to have what perhaps you couldn't entirely afford. In the intervening decades, credit cards developed into an almost de facto method of buying, well, almost anything.

Then came the internet and almost everything about modern life was rapidly reshaped in ways almost no one could have predicted. By the 1990s, all transfers from the Federal Reserve to banks (and vice versa) were done electronically. The very first consumer internet buy is believed to be a pizza order in 1994 via Pizza Hut's website. Less than a year later, the world welcomed Amazon.

Today, people now use direct deposit on accounts they only interact with online, and then spend that money online or through apps or other forms of smart payment. Researchers estimate that just 8% of currency in the entire world now exists as cash in circulation. In 2021, U.S. consumer online spending —that's 14% more than in 2020.

agencies // Shutterstock

1997: The first digital wallet is created to pay for Coca-Cola at vending machines

Today, technologies like Apple Pay have made it quite commonplace to carry your financial information in a digital "wallet" in your smartphone. But it is surprising that the first instance of paying by mobile phone happened 25 years ago. In 1997, a very limited rollout of special Coca-Cola vending machines in Helsinki allowed people to have a Coke via text message.

Since then the concept of a digital wallet has gone from strength to strength. Google Wallet was introduced in 2011, followed shortly by Passbook by Apple, which has since morphed into Apple Pay. Different countries have their own proprietary versions of these services that conform to local regulations. In just the last few years, other retailers and vendors have begun to offer their own digital wallets, among them Walmart, Samsung, and Venmo.

Parilov // Shutterstock

Late 1990s: Microtransactions are built into video games to convert currency to digital assets

We think of microtransactions as a 21st century innovation, with games like Candy Crush that nudge users to spend $1 at a time on extra lives or to unlock content.

But the first instance of microtransactions dates back to 1997 when a developer on a multi-user dungeon game used them to sell in-game credits players could redeem for character bonuses. MUDs are even far older than 1997, but they'd previously asked users to pay hourly for access.

The advent of web portal and internet service provider America Online—more commonly known as AOL—had normalized a different fee structure, the flat monthly rate, effectively killing the per-hour model.

In order to diversify the possibilities for players and revenue generation alike, Iron Realms Entertainment founder Matt Mihaly launched Achaea as a free-to-play game that also offered players the chance to buy credits for enhanced abilities or character traits within the game.

oatawa // Shutterstock

2000s: Blockchain is developed as a distributed ledger for monetary transactions

This list includes several financial technologies that are huge networks with centralized authorities, like Western Union and SWIFT. Blockchain is the opposite: a technology whose selling point is that there is no centralization. Transactions occur in, well, chains—with each subsequent transaction an additional link that also secures what came before it.

While several pieces of tech that go into blockchain existed beforehand, the original blockchain was designed to support bitcoin in 2008, and new cryptocurrencies have continued to spring up since.

Blockchain is closely linked with cryptocurrency at this point, but experts cite other opportunities to use it, such as for supply chain management.

Rido // Shutterstock

2010s: Rise of cash transfer apps enable daily microtransactions

If the development of modern financial transaction systems is a spectrum, on one end there are traditional financial networks like SWIFT, and at the other end are decentralized cryptocurrencies.

Holding the middle ground, in a way, are peer-to-peer financial apps, which allow users to pay each other for pretty much anything, from pizza nights to shared Lyfts, or to support groups and organizations who use services such as Venmo or Cash App for fundraising and investment purposes.

These apps typically allow very fast withdrawal or resending of funds, making them super flexible. The popular digital wallets Apple Pay and Google Pay both support peer-to-peer money as well. Today, you can even directly send money using many social media networks.