Most of the Speculation and Vacancy Tax declarations have been received from homeowners in the affected areas, according to a statement from the provincial government issued May 17.

The Ministry of Finance announced that, as predicted, more than 99 per cent of British Columbian homeowners who have filed a declaration are exempt from the tax.

Of the property owners who will have pay the tax, the ministry said that more than 80 per cent are either foreign owners, satellite families or Canadians who live outside of B.C.

That means just under 20 per cent of speculation tax payers will be British Columbian residents who own second homes or recreational properties in affected areas of the province, and keep them mostly vacant.

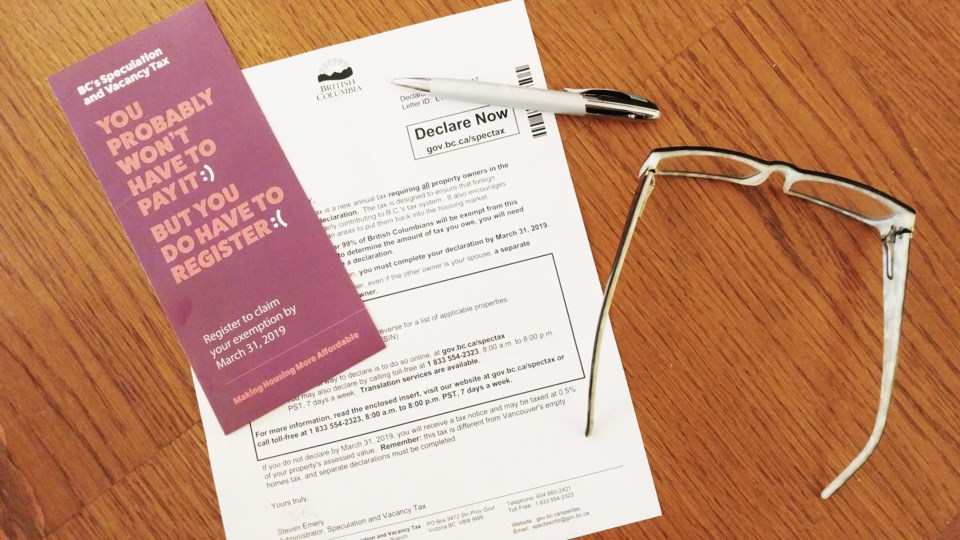

All homeowners in the affected areas are mandated to file a declaration, with co-owners of homes such as spouses each required to fill in and return their own declaration form.

The affected areas are Greater Victoria, Nanaimo, Lantzville, Metro Vancouver, the Fraser Valley, Kelowna and West Kelowna.

For those whole will have to pay the annual tax, it amounts to 0.5 per cent of the property’s assessed value for Canadian-resident owners of B.C. property, and two per cent for overseas owners.

The deadline for the form was March 31, but the government is showing considerable leniency to latecomers.

The ministry said in the statement, “Owners who do not complete a declaration will receive a tax notice of assessment before the end of May reminding them of their requirement to complete a declaration. A declaration must be completed to claim an exemption or to determine eligibility for a tax credit. If owners are not exempt, they must pay their assessed amount by July 2, 2019.”

More information can be found at .