Canada’s construction sector generated $87 billion in residential projects in 2018 and $53 billion in commercial and industrial real estate in nearly 1,500 projects. Infrastructure to support new development and population growth tallied another $70 billion in 280 major projects.

This year started with significant headwinds from government policy aimed at reducing residential demand, but it is estimated that 210,000 new homes will be started in 2019 and 300 million square feet of new commercial and industrial space will begin construction.

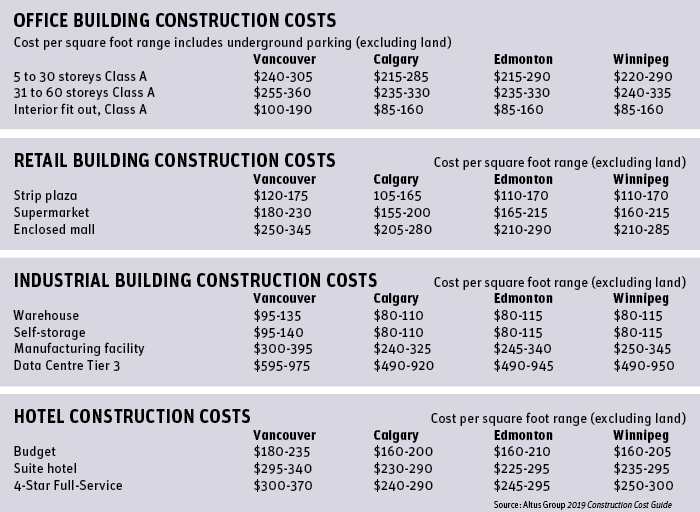

That construction comes with a cost, as detailed in the Altus Group’s 2019 Construction Cost Guide. The annual guide is trusted as a budgeting tool by public bodies, developers, lenders, contractors, consultants and various industry professionals.

The guide is founded upon Altus Group’s proprietary database of project costs, which includes project data from over 1,300 Canadian cost and project management engagements in 2018 alone. Drawing upon this comprehensive catalogue, Altus has analyzed the information and provided a succinct summary of the findings for each major market across the country.

The construction costs presented here represent hard costs only, and do not include soft costs, such as legal and insurance costs, government fees, financing costs, environmental costs, property taxes, marketing and sales costs and commissions, or the developer profit.

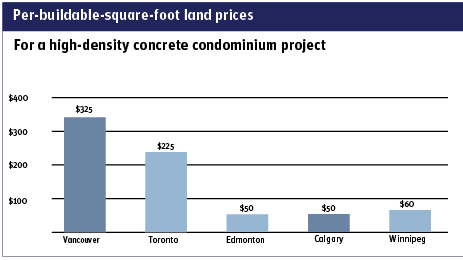

However, since land costs, especially in Metro Vancouver, have an effect on housing prices, Altus has included a breakdown of the per-buildable-square-foot costs for high-density residential based on land values.

In the city of Vancouver, where an acre zoned for high-density residential can top $40 million, the average price of a new high-rise condo apartment is now $1,345 per square foot, according to a survey by Century 21, up 39 per cent from a year ago.