City of ¬È∂π¥´√Ω”≥ª≠incentive programs for building rental housing have produced hundreds of rental units, but more incentives may be needed to bolster supply, according to a staff report delivered to council July 24.

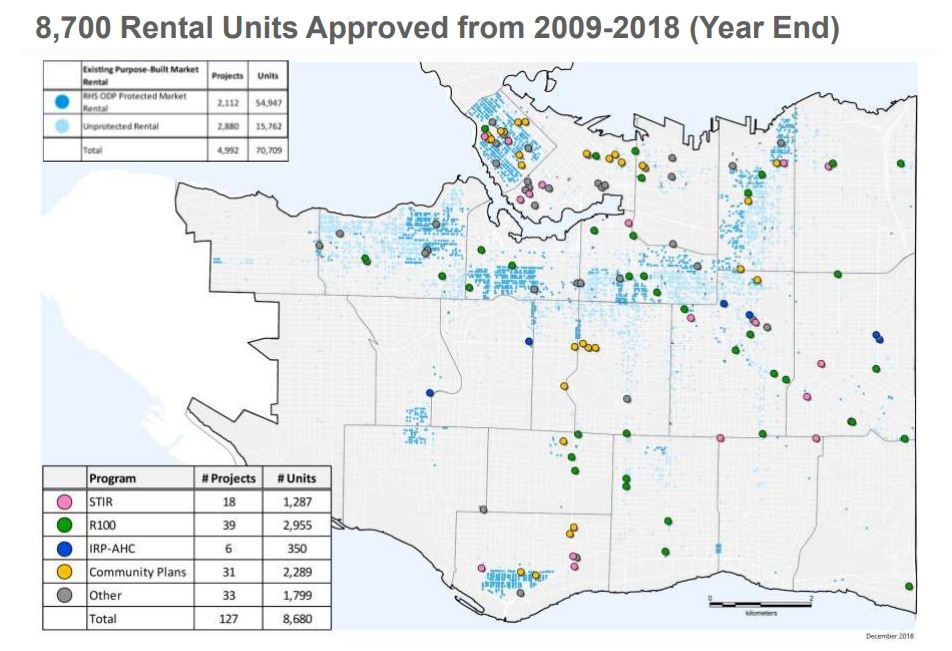

The report outlined findings of studies conducted by two independent consultants — CitySpaces and Coriolis Consulting Corp. They reviewed and analyzed the rental incentive programs the city has launched over the past decade, including STIR (Short-term Incentives for Rental), Rental 100, the Affordable Housing Interim Rezoning Policy and community plans with rental incentives such as the Cambie corridor, Grandview-Woodlands, Marpole and West End plans.

“What that showed is that, first of all, the rental incentive programs were successful at creating increased rental supply after decades of a lack of supply in the city,” said Dan Garrison, assistant director of housing policy and regulation.

“We’ve secured about 8,700 units of rental housing through those programs over the last 10 years. It also showed that the rental incentives that the city provides currently are absolutely necessary in terms of incentivising the delivery of new rental housing; that without those incentives, essentially, it would be very difficult to build any rental housing in the city and we would see a significant drop in the supply of rental.”

Although the majority of ¬È∂π¥´√Ω”≥ª≠residents are now renters, very few purpose-built rental buildings were constructed between 1980 and 2009 and much of the existing stock is old and in need of upgrades or replacement. With a vacancy rate hovering near zero, competition for available rental units is stiff and rents are high. City staff maintain more supply will increase options for renters and help address those concerns. Critics of the city‚Äôs rental programs, however, have questioned incentives such as development cost levy waivers, arguing new rental buildings aren‚Äôt producing units that are affordable for local residents.

On Wednesday, Garrison said the review of the programs revealed that the incentives the city currently provides are only enough to make rental projects “just barely marginally financially viable.”

“Again, without the incentives that the city provides such as additional density, development cost levy waivers etc., there would be very little rental supply in the city and most of the development that we would see would be strata condominium development,” he said.

“Staff’s report to council today reiterated the importance of our rental incentive programs in delivering housing that’s really needed for middle-income households in the city.”

The report cited several issues that need to be considered with respect to rental programs, including an over-supply of parking in market rental buildings. A post-occupancy survey found that 57 per cent of respondents don’t use available parking in their building, and 52 per cent didn’t own a car, while a survey of industry groups found that less than half of parking spaces are being used. Parking construction costs per stall range between $20,000 and $45,000, and can represent between 10 to 20 per cent of total project construction costs, according to the city report.

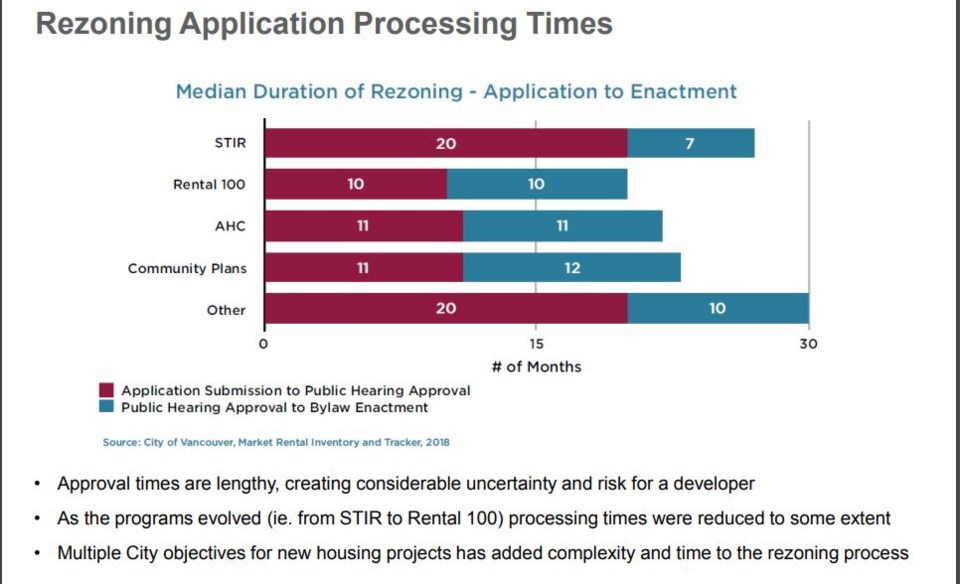

Long rezoning application process times were also cited as an issue because they create uncertainty and risk for developers. The shortest process times were for Rental 100 applications, which took about 20 months from application submission to public hearing approval and bylaw enactment.

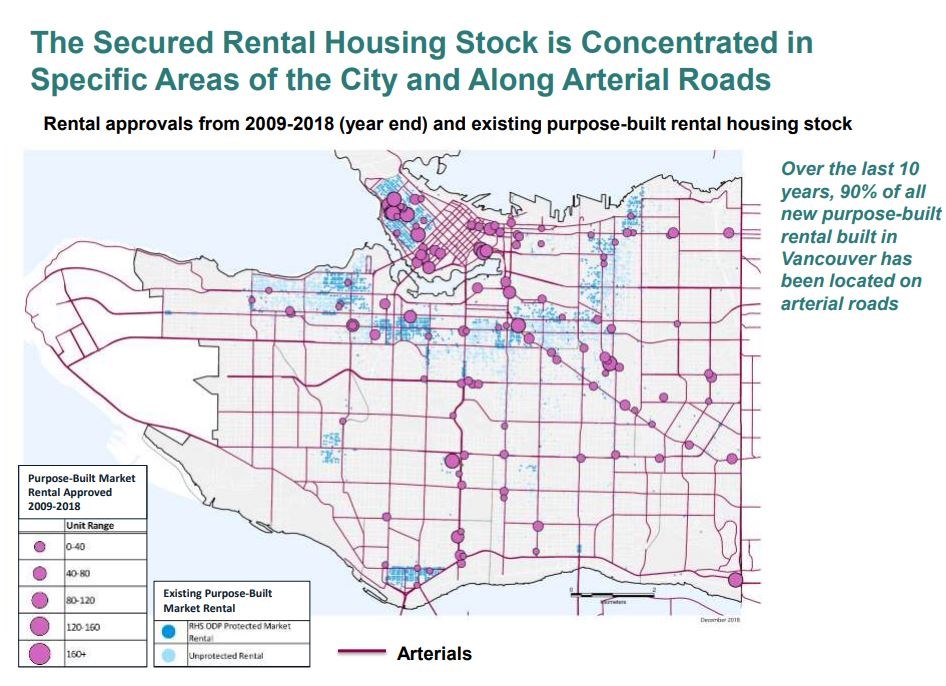

Meanwhile, over the last 10 years, 90 per cent of all new purpose-built rental built in ¬È∂π¥´√Ω”≥ª≠has been on arterial roads.

“Allowing more market rental housing in lower density areas is important for geographic equity but neighbourhood integration needs to be considered,” the report states.

Staff will now use the findings to start developing policy recommendations for council about how rental incentive programs can be improved and streamlined. Staff will also look at whether any new policy or program initiatives could be created to further incentivise new rental supply, at how more affordability could be embedded into rental programs, and if new areas of the city that could, potentially, be made available for rental housing.

Garrison expects a report with recommendations will come back to council in late November or early December.

While the housing market is slowing down, he thinks that may be positive for rental development.

“We think that there could be an opportunity at this time, a window of opportunity, for us to perhaps increase the supply of rental housing as developers and investors are looking for development projects that will be lower risk and rental projects may fit that bill,” he said.

Garrison also said the city needs to dramatically increase the number of new rental units to meet its targets.

"Our targets are for 20,000 units over 10 years for secured market rental housing. That really relies on the fact that we know that some of the strata condominiums that will be built will be owned by investors and will be rented. If it wasn't for that investor-driven secondary supply, we would need even more purpose-built rental housing," he said.

"We've only been delivering, even with our rental incentive programs, about 800 or 900 units a year on average over the last 10 years. We need 2,000, so we need a significant increase in rental supply."