The City of Â鶹´«Ã½Ó³»estimates it will bring in $38 million from the first year of the empty homes tax — $8 million more than .

So far, about $21 million has been collected. Most of the revenue will be used for affordable housing initiatives — — but it will also cover one-time implementation costs ($7.5 million) and first-year operating costs ($2.5 million).

The latest numbers were revealed in the city's first empty homes tax annual report, which was released Nov. 29. In the first year, close to 184,000 declarations were submitted, representing 99 per cent of all residential property owners in Vancouver.

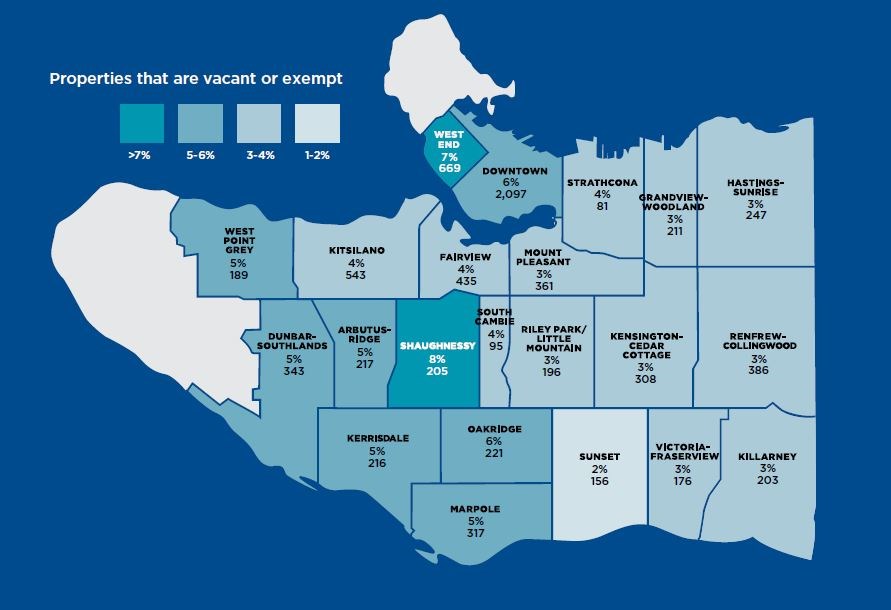

Out of the total 186,043 properties, 178,120 were occupied, 5,385 were exempt and 2,538 were vacant.

Under the empty homes tax program, which was approved in late 2016, owners are required to rent out their empty or under-utilized, non-principal properties for at least six months of the year. The six months don’t have to be consecutive, but must be in periods of 30 or more consecutive days.

The goal is to motivate homeowners to rent out homes they don’t live in full time. Vancouver’s current vacancy rate sits at .8 per cent. The empty homes tax is implemented at a rate of one per cent of a property’s assessed taxable value.

Measuring the success of the tax is difficult, according to the City, but it will continue to monitor the impact of the tax on housing supply and affordability, including the empty homes tax property status declarations data year over year.

“Isolating the effect of a single policy like the EHT in a rental market as dynamic as the City of Â鶹´«Ã½Ó³»is challenging,” the first-year report states. “With the first year of the declarations complete, staff will begin monitoring the changes in the number of vacant properties on an annual basis.”

In 2017, 2,132 property owners failed to file declarations and were initially deemed vacant. They were required to submit a notice of complaint with supporting evidence for consideration and potentially to have the tax rescinded. Complaints were also triggered when a property owner was selected for an audit and disagreed with the determination or declined to provide supporting documents and other information at the audit stage.

The total complaints the vacancy tax officer received, including those related to properties that were deemed vacant because owners didn’t make a declaration, to Nov. 18, were:

- Complaints: 1,459

- Accepted: 1,207

- Rejected: 252

- In progress: 82

The declaration period for the second year of the tax is now open. The deadline is Feb. 4, 2019. Property owners who have yet to receive their advance property tax notice in the mail can still make their declaration online using the folio and account numbers from their previous tax notice.

Those who need help to make their declaration online can visit city hall or any Â鶹´«Ã½Ó³»Public Library branch for in-person guidance, connect with the city using the or call 3-1-1, which offers translation services. Instructions for how to declare are also available in multiple languages online.