Foreign buyers, population growth, shadow flipping and money laundering are mainly to blame for the Metro Â鶹´«Ă˝Ół»housing crisis, according to respondents of an Insights West poll released August 2.

Nine in 10 agree (with 64 per cent strongly agreeing) that the region is in a major housing crunch – rising to 98 per cent among residents earning less than $40,000 a year and 97 per cent among those renting their home (97%). No matter what the income level, respondents had strong opinions about what was the cause of this problem.

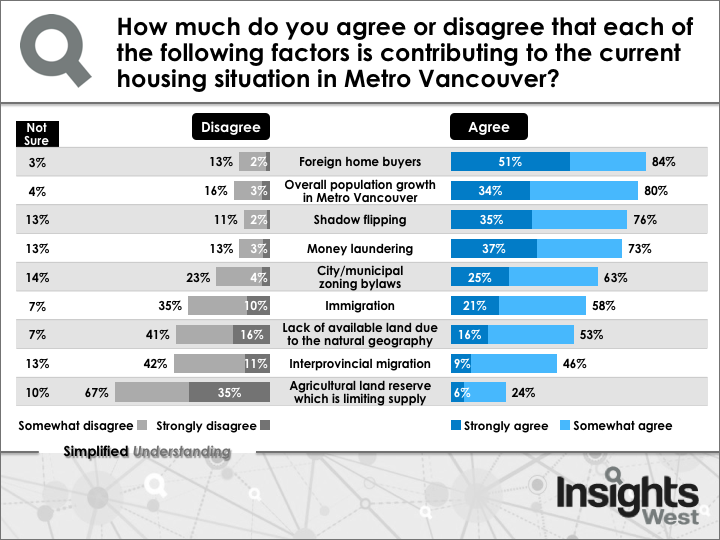

Foreign buyers were cited by a whopping 84 per cent of the respondents as a key cause, followed by population growth in the region (80 per cent), shadow flipping (76 per cent) and money laundering (73 per cent).

There were other factors cited as key reasons for the housing crisis, although to a lesser degree. These included municipal zoning bylaws restricting housing supply (63 per cent), immigration (58 per cent), lack of available land due to the natural geography (53 per cent) and interprovincial migration (46 per cent).

Steve Mossop, president of Insights West, said, “There is no doubt that Metro Â鶹´«Ă˝Ół»residents believe that we are in a major crisis when it comes to housing, and the issue is dominating public opinion and the public agenda.

“What is surprising, though, are the misconceptions that exist with respect to the culprits and causes of this crisis. As the housing situation reaches crisis proportions, there is no shortage of scapegoats to blame, despite studies that show foreign buyers and money laundering are minor factors in the equation.”

Housing affordability is seen as the number one issue currently facing British Columbia by 48 per cent of Metro Â鶹´«Ă˝Ół»residents, with those aged 18-34 notably more concerned (72 per cent) about the issue than older respondents (41 per cent of those aged 35-54 and 33 per cent of those aged 55 and above).

However, despite many homeowners benefitting from rising home prices, only 26 per cent feel that the housing situation has had a positive impact on them, with 33 per cent saying there is no impact at all, and the remaining 41 per cent believing it has impacted them in a negative way. Â