If you’re a homeowner with property in one of B.C.’s speculation and vacancy tax areas, you should gone online to declare your home’s use by yesterday’s deadline. But for those who didn’t file their declaration, there’s still time, according to the Ministry of Finance.

The speculation and vacancy tax is applicable on all non-primary residences that are left vacant for more than six months of the year, and not rented out long term. The tax in 2018 is 0.5 per cent of the home’s assessed value. In 2019, the rate remains at 0.5 per cent for Canadian citizens and permanent residents who are not part of a satellite family, but rises to two per cent for overseas residents and satellite families.

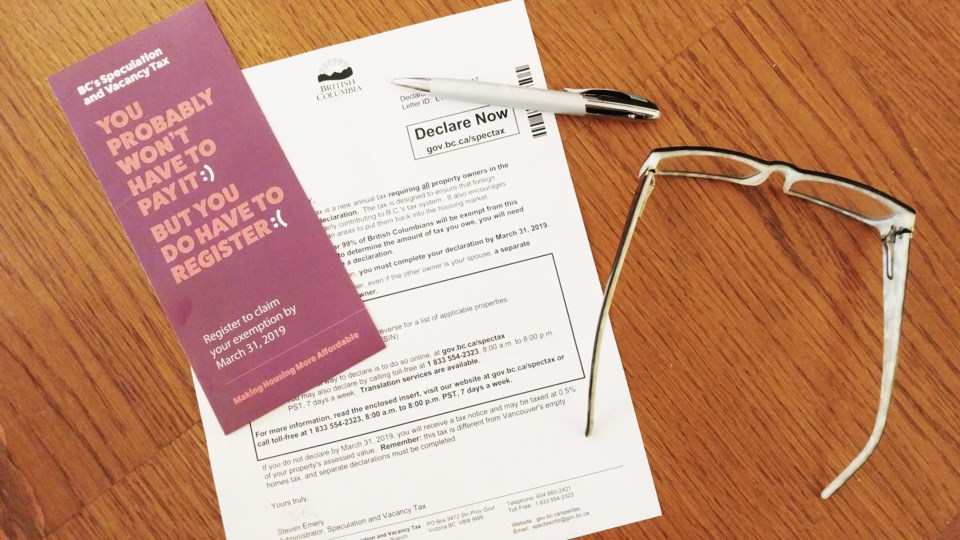

All owners of property in Greater Victoria, Nanaimo, Lantzville, Metro Vancouver, the Fraser Valley, Kelowna and West Kelowna should have received a letter in January or February prompting their online declaration, which was due by March 31.

The ministry announce March 29 that 91 per cent of the approximately 1.6 million homeowners who are not liable for the tax have successfully claimed their exemption ahead of the deadline.

However, finance minister Carole James said the province will follow up with those who missed the deadline, and those who are exempt won't have to pay it, despite being late with their declaration.

“If there are extenuating circumstances ... they have the opportunity to be able to do a follow-up,” James said Friday.

With nine per cent of British Columbians in the affected areas having failed to declare their property use, that totals about 144,000 people – much higher than James’ estimate of the 32,000 owners who are liable for the tax. This could result in up to 112,000 B.C. homeowners soon receiving a bill for a tax for which they are not liable.

It has not been reported by the province how many of the estimated 32,000 people who are liable for the tax are overseas owners and satellite families, and how many are British Columbian and Canadian owners of vacation cabins and second homes.

“The speculation and vacancy tax is an essential tool to help make sure people who live and work in B.C. have a place to call home,” said James. “We’re asking people to help make housing more affordable by helping us identify vacant properties and ensuring foreign owners and satellite families are paying their fair share.”

The stated aim of the tax, when it was launched, was to reduce the number of vacant homes and increase the supply of rental housing.

James said, “Our plan is working. Since May, the home prices in Greater 麻豆传媒映画have dropped in all segments of the market. We’re doing exactly what people asked us to do — working to make sure British Columbians can find and afford a home.”

Homeowners in the affected areas who have not received a letter and/or are still due to submit their declaration should call the province’s speculation tax hotline at 1-833-554-2323, which is open 8am to 8pm.

— With files from Times Colonist