Almost six in 10 Canadian millennials are already homeowners, with more of this age group planning to buy a home in the next two years, according to a Genworth Canada survey released May 7.

As part of its Homeowner Education Week May 7-11, the mortgage insurance company published the results of its nationwide survey of 2,000 Canadian homeowners and renters.

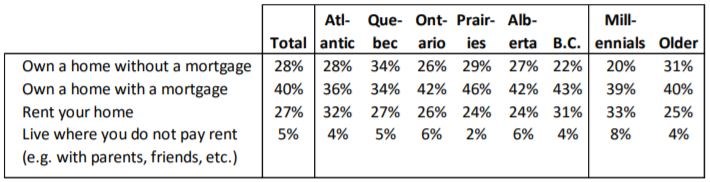

The found that 59 per cent of millennial respondents own a home. That breaks down as 39 per cent owning a home with a mortgage, and a surprising 20 per cent of all millennial respondents owning a home without a mortgage.

Out of the 41 per cent of millennials who don’t yet own a home, 30 per cent plan to buy in the next two years (12 per cent of all millennial respondents). That makes a total of 71 per cent of Canadian millennials who either own a home or are planning to buy one soon. With millennials representing a sizeable cohort as the children of baby-boomers, this age group has become the “engine” of Canada’s real estate market, said Genworth.

The study focused on the “financial fitness” of its respondents, and the role that home ownership plays in financial wellbeing. It found that the respondents who own a home are far more likely to say that they are in “great” or “good” financial shape than those who do not own – unsurprisingly, given that most people have to be in good financial shape to afford to buy in the first place.

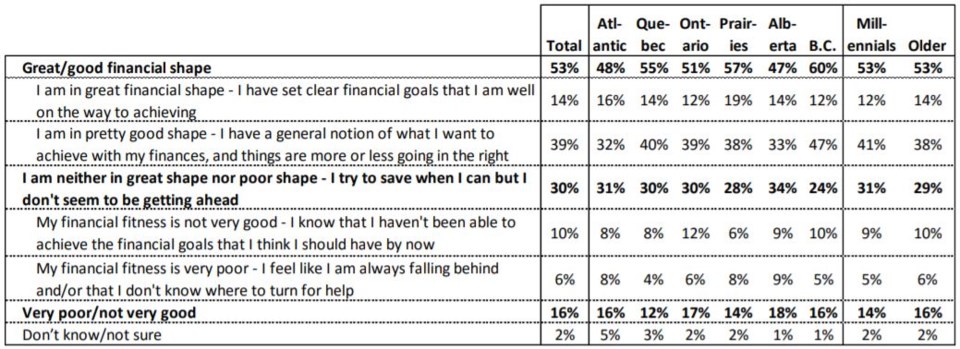

According to Genworth, being in great financial shape is described as “I have set clear financial goals that I am well on my way to achieving” and good is “I have a general notion of what I want to achieve with my finances, and things are more or less going in the right direction.”

Among the different groups of respondents, 68 per cent of Canadian first-time buyers said they are in great/good financial shape, compared with 58 per cent of those who intend to buy their first home in the next two years. That figure is similar to the 59 per cent of repeat homebuyers and 62 per cent of those who intend to buy a home that is not their first.

Millennial respondents were just as likely as older Canadians to say they are in great/good shape (53 per cent in both age groups).

Broken down by province, respondents in B.C. were the most likely (60 per cent) to say they are in great or good financial shape. Those in Alberta (47 per cent) were the least likely to feel this way.

The report authors concluded, “These encouraging findings come at a time when the Canadian economy is strong, and unemployment and interest rates are low by long-term standards. Should economic conditions worsen, many may find their financial fitness is no longer as rosy as they thought. Now is a time for homeowners to set aside six to 12 months’ worth of savings and take advantage of double-up or extra lump-sum mortgage payments.”