Despite the market slowdown, Metro Vancouver’s housing market is still showing a “high degree of vulnerability” to key risk factors, according to the latest quarterly report released February 7 by Canada Mortgage and Housing Corporation (CMHC).

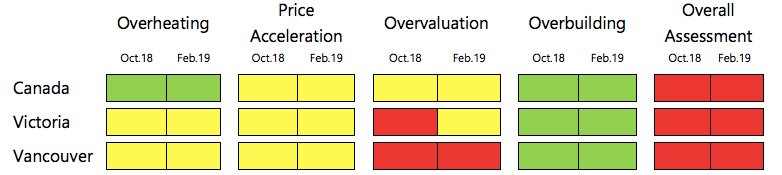

The federal housing agency’s report examined the metropolitan area’s market activity in the fourth quarter of 2018, and maintained the same ratings from the . In particular, it found continued high evidence of overvaluation of real estate, even though prices in 2018’s fourth quarter had slipped from earlier in the year.

CMHC’s quarterly examines urban real estate markets across Canada, assessing a combination of four key risk factors: overvaluation of house prices in comparison with levels that can be supported by economic fundamentals; overheating, when demand for homes in the region outpaces supply; sustained acceleration in house prices; and overbuilding, when the inventory of available homes exceeds demand.

CMHC also found that in 2018's fourth quarter, Metro Â鶹´«Ã½Ó³»remained at “moderate risk” of overheating and and price growth acceleration. The report said that even though prices are slowing, the HMA framework dictates that a risk of price acceleration is still present if there have been significant price surges in "at least one quarter in the prevous three years" — in this case referring to the skyrocketing prices of 2016.

Limited inventory of new homes has led to low evidence of the fourth risk factor — overbuilding.

Eric Bond, manager, market analysis at CMHC, said in the report, “Home price levels [remain] high relative to local incomes and economic fundamentals, leading to CMHC’s continued detection of overvaluation in the Metro Â鶹´«Ã½Ó³»housing market.”

The report authors added, “While the imbalances in the [Metro Vancouver] market are now narrowing… these developments are recent and additional evidence is needed to change our assessment. If current trends persist with the easing of overvaluation conditions, overvaluation will move from high to moderate.”

Bob Dugan, CMHC’s chief economist, told a media conference February 7, “Overvaluation doesn’t really have anything to do with affordability. They are two separate concepts. You can have prices in line with fundamentals, and no overvaluation, but that doesn’t mean affordability isn’t a challenge. It just means that there is a relationship between economic fundamentals and home prices that can explain the level of those prices.”

Toronto and Victoria, both of which have seen high levels of overvaluation in recent quarters, had their overvaluation risk factors downgraded to moderate in the new report. Both markets remained at a “high degree of vulnerability” overall.

Across Canada as a whole, the housing market remained “highly vulnerable” despite none of the four individual risk factors being rated as high.