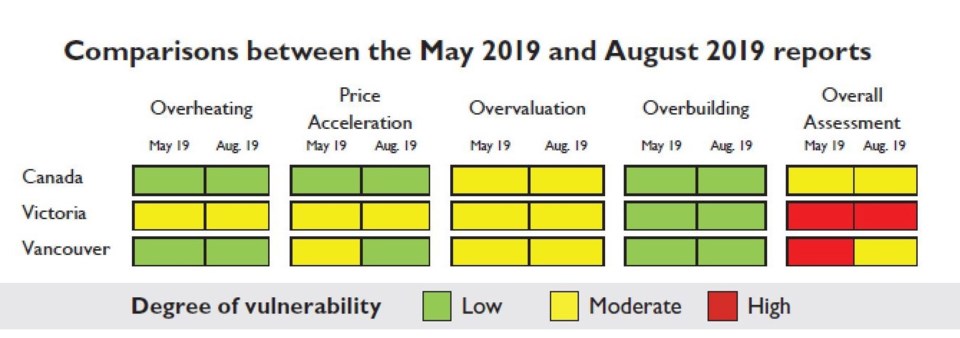

Metro Vancouverâs housing market has received a âmoderate degree of vulnerabilityâ rating, after three years of âhigh degree of vulnerabilityâ ratings, from the Canada Mortgage and Housing Corp. (CMHC).

CMHCâs HMA examines urban real estate markets across Canada, assessing a combination of four key risk factors: overvaluation of house prices in comparison with levels that can be supported by economic fundamentals; overheating, when demand for homes in the region outpaces supply; sustained acceleration in house prices; and overbuilding, when the inventory of available homes exceeds demand.

In its quarterly Housing Market Assessment (HMA), issued August 1 and examining the market in 2019âs second quarter, the federal housing agency said that price acceleration had eased sufficiently to downgrade the Â鶹´«Ã½Ó³»real estate marketâs risk assessment. The only factor that remained at moderate risk was overvaluation of real estate, said the CMHC, while the other three factors were all at low risk.

Eric Bond, senior specialist, Market Analysis at CMHC, said of the Â鶹´«Ã½Ó³»market, âWhile home price growth over the past few years significantly outpaced levels supported by fundamentals, these imbalances have narrowed through growth in fundamentals and lower home prices in different segments of the resale market.â

However, Greater Victoria â along with Toronto and Hamilton, Ontario â remained at high risk, according to the CMHC. Victoriaâs market still showed moderate risk of overvaluation, price acceleration and overheating, said the agency, but these are showing signs of easing. âThe decline in price and growth in fundamentals have helped to narrow the average estimate of overvaluation in Victoria,â wrote the report authors.

Canadaâs housing market as a whole was given a âmoderate degree of vulnerabilityâ rating, but the report authors acknowledge that âregional disparities exist.â