They’ve cashed in and moved out of town, having absolutely no regrets.

Edwin Hoekstra, a retired strata management company manager, and his girlfriend Liz Robson followed what many in their golden years, or about to enter that time of their lives, have done by selling their Delta home and buying a one in a smaller community elsewhere in the province, pocketing more than enough to enjoy life.

It’s all thanks to the once white hot Lower Mainland real estate market that saw crazy price escalations a couple of years back.

Although that rise is over and prices have slid somewhat, the good news for Hoekstra was there wasn’t a significant downturn in the value of his home, a 40-plus-year-old fixer-upper. It resulted in a great opportunity to cash in and get more bang for his buck elsewhere. That meant leaving not only Delta but the Lower Mainland altogether.

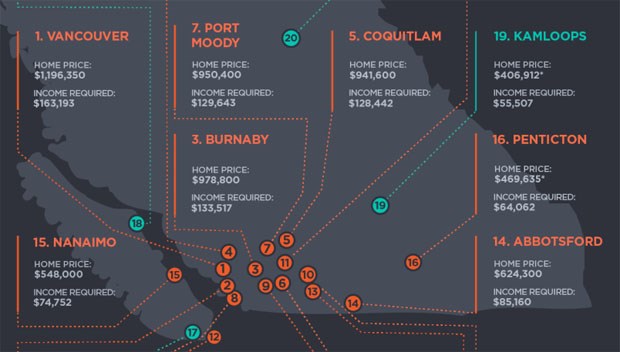

Hoekstra is one of those fortunate enough to have purchased his home a couple of decades earlier in the days when there wasn’t a prohibitive gap between housing prices and income. A recent study from Canadian real estate firm Zoocasa found that’s no longer the case as there isn’t a single market across Metro Â鶹´«Ã½Ó³»where a household earning the median income can afford an average single-family home.

Earlier this year, Hoekstra purchased a relatively new and much larger house in Coldstream, just outside of Vernon, with a stunning lake view, new appliances and other modern features, as well as more than enough room for guests. The move also left Hoekstra and Robson extra money to travel and the two will be spending a big chunk of this winter, and future winters, in sunny resorts.

“It was more a matter of moving out because the house here, in my opinion, was a teardown, so I had the option of flattening it and putting up another house or just say, ‘The heck with it, I’m moving out and we’ll find something else,’” says Hoekstra.

“We listed the house for $938,000 and we got six offers and the best offer was $1.1 million. It wasn’t a bidding war, this guy beat out the other offers. The guy said he’s asking this much over asking because he wanted us to move out in six days. I said, ‘For $165,000, I can move out in one day.’

“The only problem was we were in the Dominican Republic, so I had to call the movers to move us out in six days. When I came back home I was homeless,” he laughs.

“We didn’t do any house hunting beforehand and started house hunting after the deal was closed, which was pretty fast. We didn’t mind looking outside Delta, which would have been too expensive, and we like the lifestyle. We didn’t spend the $1.1 million for our bigger place. We did spend $890,000. The same house would be $3 million here.”

Jennifer Hunt, vice-president of the Real Estate Investment Network, says they’re hearing similar stories. It’s the older demographic moving away and the younger crowd taking their places, for the most part.

“We are seeing that and it’s based on affordability. People are taking advantage of that higher market rate and they are moving to Victoria, Kelowna, Vernon, as far as that for sure. My own in-laws took advantage of that.”

A story in the Delta Optimist last year about the Tsawwassen Legion’s struggles is a good anecdotal example highlighting how older people are moving away. Until it was thrown a lifeline, the Legion was set to shut its doors due to a lack of funds that were attributed to a dwindling membership and volunteer base.

“We had a lot of members just in the past couple of years who have moved out of the community and live elsewhere. When the house prices went up we easily lost 30 or 40 members. A lot of these people were 70 or 80 (years old) and they were sitting on a big chunk of money, so decided to sell. The demographics here is a lot different now,” president Gary Bain said in an interview at the time.

Anne McMullin, president of the Urban Development Institute, notes it’s difficult to quantify exactly just how many seniors are cashing in and moving out of the region. Many still want to stay in or close to the neighbourhoods they’d lived in for decades but find themselves with few options.

“There’s some data around Victoria and Kelowna. What we’re finding is people are cashing out, what you’d say downsizers, and aren’t moving from Â鶹´«Ã½Ó³»to Coquitlam. They’re going to Kelowna, Victoria or up (Vancouver) Island, Comox, Courtenay… It’s not just retiring baby boomers, it’s also people who are not ready to retire just yet. Then you have millennials mixed in,” McMullin says.

Leading Delta real estate agent Fraser Elliott says he isn’t seeing a mass exodus but admits more and more of the baby boomers are cashing in and moving into the Fraser Valley and beyond for their retirement years. If more housing options were available locally, he explains, Delta would certainly be able to keep locals in the community.

“There isn’t enough market options, therefore, many boomers choose to cash in on the value of their home and leave the area, searching in the valley, even though they would prefer to downsize locally,” Elliott says.

“More supply across Metro Â鶹´«Ã½Ó³»will certainly help alleviate pressures on housing overall.”

Gordon Price, director of the City Program at Simon Fraser University, agrees, but notes multiple factors come into play when people decide to cash in and move out of town, including housing affordability, an issue which is challenging all levels of government.

Demographics is also a big factor in that people decide to move because they don’t like how their neighbourhoods are changing.

“Once you’ve basically made the change, like turning those strip malls into high-rises or medium-rises, people will start getting used to that status quo and maybe not be so interested in leaving, wondering what all the fuss was about. It’s making the initial transition which is the hardest part. It’s a fascinating dilemma for politicians and planners because they can see what’s coming,” Price says.

For some, changes in their communities have been too much, so they decide to move to smaller communities, not only to cash in but to try to improve their lifestyle.

Former Delta Teachers’ Association president Paul Steer is one of them, having sold his larger home in Sunshine Hills to relocate to the tiny community of Midway, located in the West Kootenays.

Steer says that while the benefits of downsizing to a smaller, much more affordable home are obvious, factors such as densification and traffic finally convinced him to start his retirement years elsewhere.

“I’m in my early 60s now and my family has lived in Delta since 1969. So, as someone who’s getting older, I see the totality of all of the changes that have taken place over more than 40 years. It adds up to really negatively affect our feeling about wanting to stay in Delta.”

Price warns there could be some big problems down the road for those who have moved away as well as their new communities.

“The boomers will probably tend to cluster and they’ll cluster in places that match up to what they’re used to and desire. They’re lucky that they’ve been effectively turned into millionaires by doing nothing other than holding onto their properties. Now, if they want to make that choice for an even bigger house in the Okanagan or Â鶹´«Ã½Ó³»Island, or even Mexico, they can do it. It doesn’t take much change in demographics to lead this kind of phenomenon we’re talking about.

“But the problem is matching up the services. So, if you’re looking for hospitals and care facilities, neighbourhoods that are walkable and have transit, this is a bit of a mismatch. I think it’s going to create a crisis and I see it coming. It’s the cost of servicing an aging, disabled and increasingly ill population. It’s great you have a wonderful view property in a kind of rural environment on Â鶹´«Ã½Ó³»Island but you’re not getting the same level of services like you would in Vancouver. How do you provide assisted living for people who have clustered together in places not designed for their needs as they age?”