Home sales across the province will remain “marshmallow soft” through the rest of the year, according to a by Central 1 Credit Union.

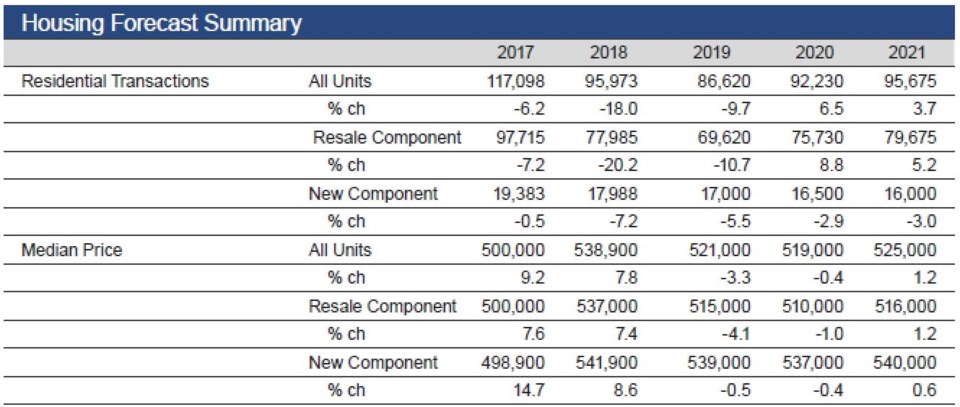

2019 will see a total year-over-year sales decline of nearly 11 per cent, province wide, said the report. This will be followed by a recovery of 8.8 per cent in 2020, taking resale transactions across B.C. to just below 2018 levels, reported deputy chief economist Bryan Yu.

That 2019 sales-drop prediction increases to 14 per cent when looking at the Lower Mainland alone.

Yu told Glacier Media in an interview, “In B.C., the market is quite different to what we’re seeing across the rest of the country, where sales have stabilized… But we are expecting a moderate rebound in sales in 2020."

He added, "This is not an economy-driven downturn, it’s a policy-driven event. The federal B20 [mortgage stress test] measures and various provincial taxation policies have all come together to drag on the market.”

Price declines

However, with price trends lagging sales declines, B.C.’s average home resale price will continue to slide for the rest of this year and through 2020, predicted Yu, with a slight uptick expected no sooner than 2021.

The province’s median home resale price across the year is expected to decline 4.1 per cent in 2019, then a further 1.2 per cent in 2020. This will be followed by the most meagre of recoveries in 2021 with a 1 per cent rise, which doesn’t even bring the median back to 2019 prices.

The biggest short- to medium-term price declines are expected, unsurprisingly, in Metro Vancouver, said Yu – but this could be what puts the market back on track in the longer term.

“In Metro Vancouver, on a benchmark basis, prices are down around eight per cent and we’re expecting that to fall further, giving us a total peak-to-trough decline of about 12 to 15 per cent. So that will erase a lot of the gains we saw from 2016 onwards. But this should pull some people back into the market. A lot of the problems we’ve seen is just that people simply can’t afford the financing to buy a home, and this should improve… Price declines in Metro ┬щ╢╣┤л├╜╙│╗нand other parts of B.C. should motivate some people to re-enter the homeownership space. And when we look at the economy itself, it’s quite solid, we’re seeing strong job growth and population gains, which should also provide support for the housing market going forward.”

Knock-on effects

Yu’s report also looked at the knock-on effects of the more severe Metro ┬щ╢╣┤л├╜╙│╗нmarket slowdown on other parts of the province.

Yu wrote in his report, “Weak activity in Metro ┬щ╢╣┤л├╜╙│╗нis contributing to fewer recreational and retirement home purchases in other markets, as homeowners face lower price/equity and difficulty selling their properties. Sluggishness in Alberta’s economy is likely curtailing recreational sales in the interior, with the speculation tax negatively impacting recreational purchases and pushing sales out of the larger market and into smaller rural communities.”

He told Glacier Media, “The slowing of the market in Metro ┬щ╢╣┤л├╜╙│╗нmeans that homeowners feel a little less wealthy, especially if they have detached homes, and that in turn will lower demand for secondary homes in other market. These markets are all interrelated.”

Housing starts

Yu said that housing starts are also expected to decline, as this is another trend that tends to lag resale figures.

“Year-to-date housing starts are pretty level with what they were last year, which is kind of a surprise. But when we’re looking at presale numbers, or lack thereof, and how historically presales react to the resale market, we’re convinced that this will lead to a decline in new housing units going forward. Looking at the market, I can imagine a lot of developers are going to be a little wary of starting new projects.”