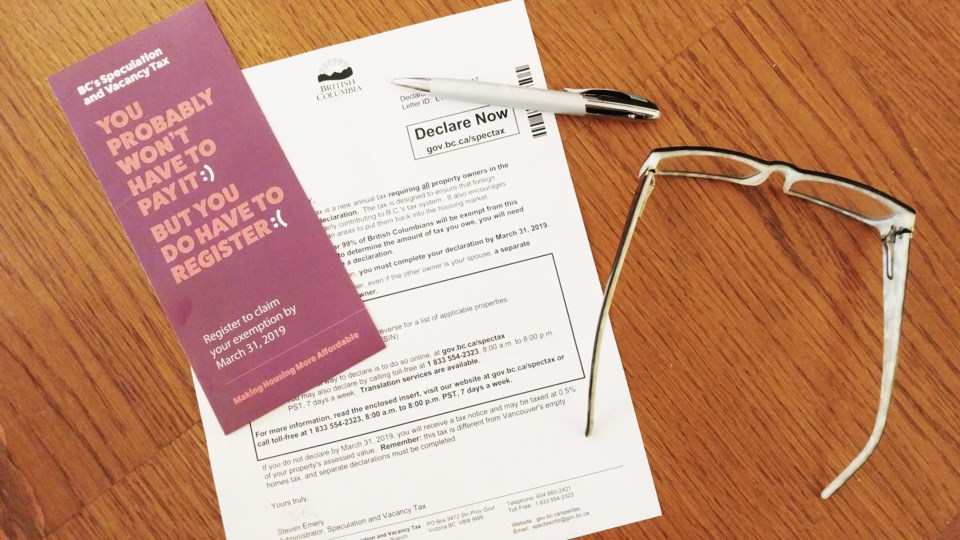

The Speculation and Vacancy Tax declaration material arrived and I began the process. I worked my way through the questions, becoming concerned when it asked about federal tax returns and wanting my social insurance number. Hold on, I thought, what’s the linkage between income and property taxation?

The SIN is a cornerstone of federal income tax and benefit programs. On their website, the feds make it clear that you don’t have to provide your SIN for identification except for specific government programs. The speculation tax is not one of them.

There is no law compelling us to provide our SIN, yet the Speculation and Vacancy Tax legislation has significant financial consequences if we don’t complete our declaration form, and you can’t complete it without the SIN.

The government tells us it is targeting one per cent of property owners who are non-Canadian, non-B.C. residents and others who don’t use their property according to the government’s concept of how it should be used. In doing so, it is developing a database of personal information on the rest of us that is more relevant to collection of income taxes. Could it be that our personal data are needed to develop more tax programs such as a capital gains tax on sale of a principal residence?

The SIN is a key element of our income-taxation system. To coerce it out of us and link it to property taxation is inappropriate. We should all be objecting.

Mark Atherton, Metchosin, B.C.