Real estate officials say Greater Victoria’s housing market is in transition as the number of monthly sales slid in October compared with the same month last year.

It marks the 11th consecutive month that total sales through the Victoria Real Estate Board have dropped.

“We continue to see the housing market shift into a more balanced state, though the trajectory is not smooth,” board president Kyle Kerr said November 1.

Although sales were down from a year ago, they increased from September, he said.

The upper-end of the market continues to soften, Kerr said. “Right now, pricing is key across all segments as we transition to a more balanced market.”

Kerr said tougher federally imposed mortgage lending rules and B.C.’s impending speculation and vacancy tax are affecting the market.

Stress tests for buyers are part of more stringent lending rules, imposed to protect homeowners in the event that interest rates increase.

“These measures have certainly had an impact on purchasing power,” Kerr said.

B.C. is planning to impose a controversial speculation tax on vacant properties this year.

Kerr said the threat of this tax has “cooled development in our area, which is unfortunate because the only way to create affordable homes in our area is to build them.”

The speculation tax adds a surcharge on second homes that are vacant in certain communities, including Victoria and Nanaimo. Exemptions are allowed if the property is rented at least six months of the year or is valued at less than $400,000.

As of 2019, owners who leave properties vacant would be charged a surtax of 0.5 per cent of assessed value for 2018.

That would rise to two per cent of assessed value in 2019 for foreign investors and “satellite families,” one per cent for Canadian citizens and permanent residents who don’t live in B.C., and 0.5 per cent for B.C. residents who are citizens or permanent residents.

As well, the Bank of Canada raised its benchmark interest rate to 1.75 per cent last week, from 1.5 percent. This was the third increase this year.

Last month saw 598 properties, representing mainly residential but also some commercial change hands through the board’s Multiple Listings Service. The total value of sales was $404.6 million.

In October 2017, there were 664 sales, with an overall value of $424.48 million.

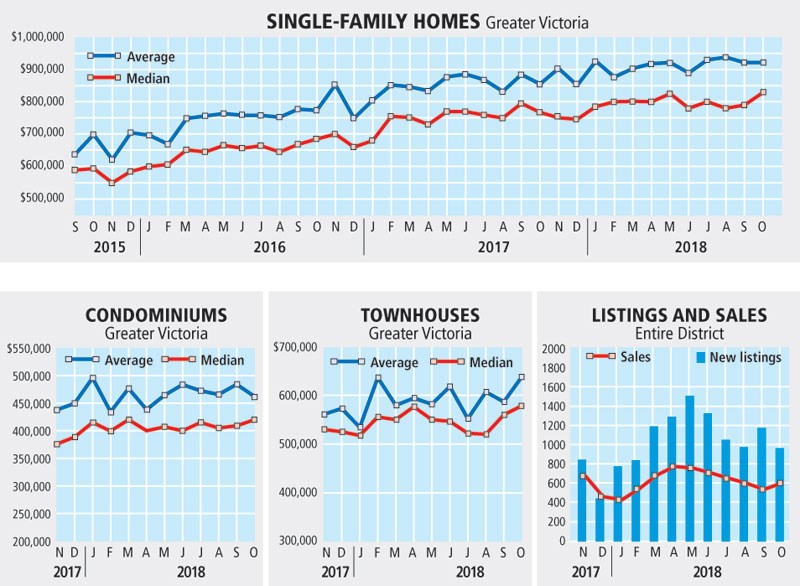

The benchmark price for a single-family home in the core of Greater Victoria was $881,000 last month. That is up from the same month last year, when it was $830,100. But October’s benchmark declined from this past September at $883,700.

The core is defined by teh board as Oak Bay, Esquimalt, Victoria, Saanich and View Royal.

Single-family prices for all of Greater Victoria came in with a benchmark of $765,300 last month. That’s because the Westshore’s benchmark is lower at $618,900. October 2017’s benchmark for the entire region was $713,100.

Sales of single-family homes have declined by 14.7 per cent year-over-year. Condominium sales also went down, by 15.5 per cent.

The benchmark price for a condominium in Greater Victoria was $495,600 last month, up from $448,800 the year before.

For the area north of the Malahat, single family house sales were also lower in October, at 385, than the same month in 2017, when 458 changed hands. Condo sales also declined by eight per cent year-over-year.

“This year’s housing market is behaving as expected, moderating after the record-setting pace set in 2016 and 2017,” the Â鶹´«Ă˝Ół»Island Real Estate Board said in a statement.

The benchmark price for a single-family house in the Â鶹´«Ă˝Ół»Island region was $508,200 last month, up by 11 per cent from October, 2017.

The benchmark for a condominium was $313,500, up by 16 per cent from the previous year.

Last month, the benchmark price of a single-family home in the Campbell River area hit $408,100, an increase of 14 per cent over October 2017.

In the Comox Valley, the benchmark price reached $501,400, up nine per cent from last year.

Duncan reported a benchmark price of $475,700, up 12 per cent from October 2017.

Nanaimo’s benchmark price rose nine per cent to $548,000 while the Parksville-Qualicum area saw its benchmark price increase by nine per cent to $570,200.

The cost of a benchmark single-family home in Port Alberni reached $300,300, up 18 per cent from one year ago.