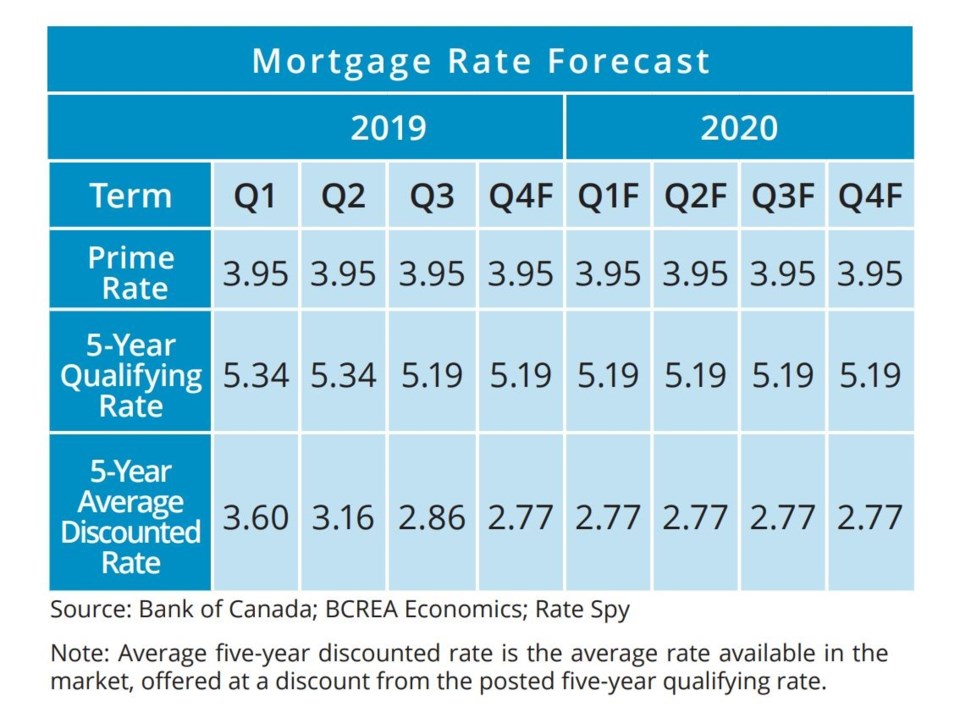

Five-year discounted mortgage interest rates are still falling and will drop to an average of 2.77 per cent by the end of the year, then hold firm for a full year, according to the B.C. Real Estate Association’s .

The average fixed five-year rate in 2019’s third quarter is expected to be 2.86 per cent, which is down from an average of 3.16 per cent in Q2. This is just an average, as some five-year fixed rates are currently available as low as 2.25 per cent.

BCREA said in its forecast that one key reason for declining rate was because “rising trade tensions between the United States and China fed growing fears of a global economic slowdown. Those fears pulled long-term Canadian interest rates low enough to invert the Canadian [bond] yield curve, a frequent — though not infallible — pre cursor to recession. As bond yields fell, the average five-year contract rate offered by Canadian lenders declined to an average of 2.86 per cent, with five-year fixed rates as low as 2.25 per cent currently available.”

The five-year qualifying rate is expected to hold firm at 5.19 per cent, having been reduced from 5.34 per cent earlier this year. Under current rules, this means mortgage applicants will still have to qualify at this rate to pass the B-20 “stress test” (or their contract rate plus two per cent, whichever is higher), despite contract mortgage rates (the amount they will actually pay each month) dropping.

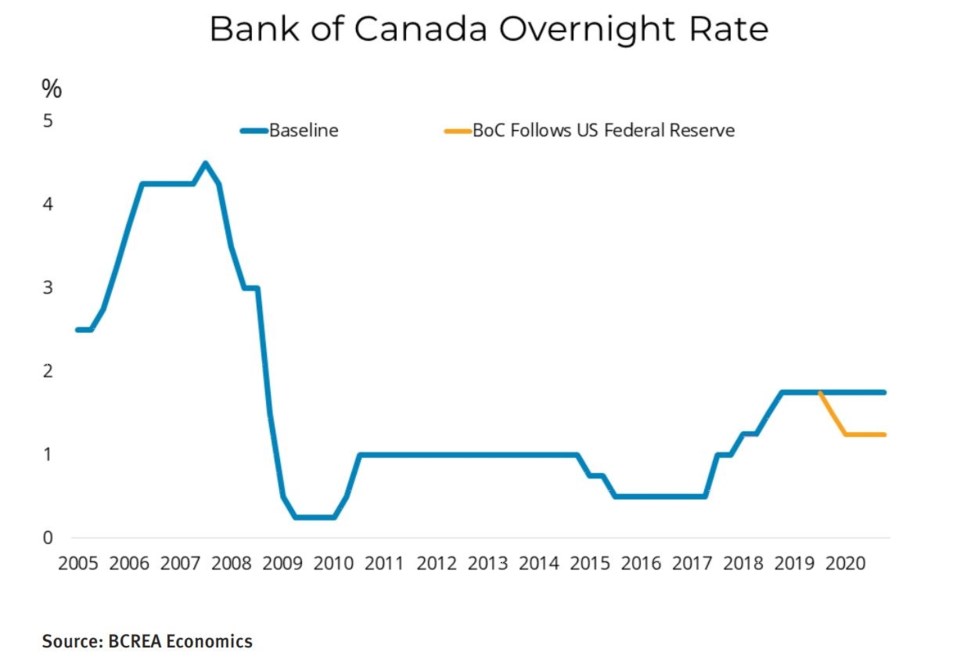

The Bank of Canada’s overnight rate — which variable mortgages are based on — is expected to hold firm, although the BCREA did not rule out a decline if the Bank decides to follow the U.S. Federal Reserve’s lead.

Overall, the report’s outlook for the Canadian economy was one of very cautious optimism. “We expect the Canadian economy will post trend growth of about 1.8 per cent in 2020, though significant downside risks remain due to elevated trade tensions and their consequent impact on exports and investment.”

On future interest rate changes, the report authors concluded, “The baseline outlook for the Canadian economy is not signalling the need for further stimulus… Policymakers remain wary of reigniting a build-up in household debt, particularly after imposing policies designed to bring those debt burdens down. We expect the Bank will therefore remain on hold as long as the Bank’s assessment of economic risk does not reach a tipping point.”