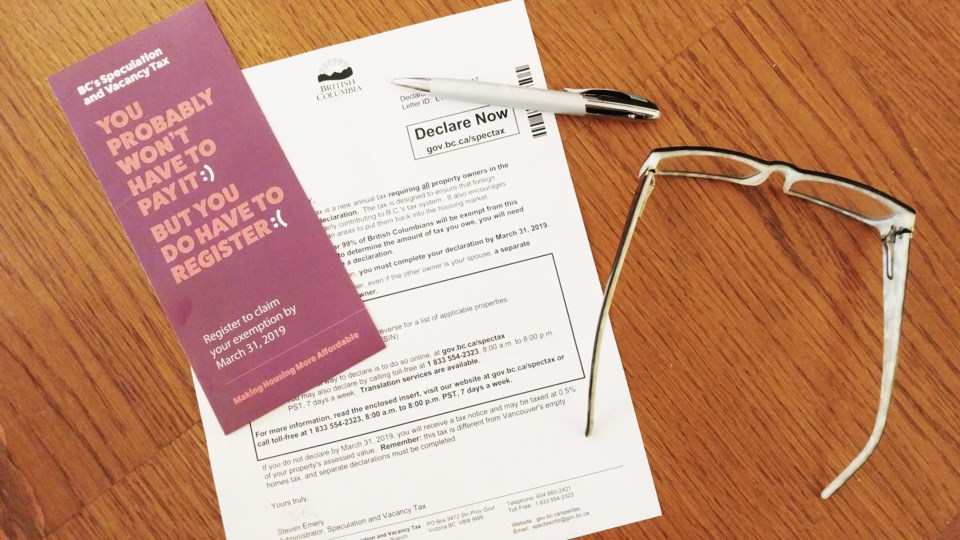

By now, most homeowners in areas affected by B.C.’s Speculation and Vacancy Tax will have received a letter from the provincial government, telling you to make your declaration by March 31.

The B.C. government says that 99 per cent of homeowners in the affected areas (see list below) will be exempt from the tax, but you must declare your home’s use in order to receive that exemption.

If you haven’t received a letter by March 1, and you own a home in one of the applicable areas, the onus is on you to chase up the tax office, and get them to send it to you in time to declare by March 31 (contact details ). Every homeowner in the affected areas must declare by March 31, and you need the letter with your unique declaration code and ID number to do so.

If you don’t declare by March 31 – even if you received no letter and/or believe yourself to be exempt – you will be charged the annual tax, which for a Canadian resident is 0.5 per cent of your home’s assessed value.

If your home is owned by more than one person – for example, it is owned jointly by you and your spouse – each of you must complete your own individual declaration.

Upon announcing the declaration process, the B.C. government said it would take individuals around 20 minutes to complete the declaration. In fact, for the 99 per cent who are exempt from the tax, the short series of online questions will take less than five minutes. For those unable to complete an online form, there is a toll-free helpline on which a representative will complete it for you – 1 833 554 2323.

The process has been further streamlined for people who own multiple properties, with just one letter (and one declaration/ID code) per owner. This allows them to declare the various uses of all their different properties within the same declaration.

Owners with non-primary residences who keep those homes empty more than six months of the year will have to spend a few more minutes on the online declaration to detail the property’s use.

Any Canadian who is found to be liable for the tax will be charged 0.5 per cent of the assessed value, per year, but B.C. taxpayers get a tax rebate of $2,000 to offset the charge on the first $400,000 of assessed value. Overseas nationals who are liable for the tax will be charged two per cent of the assessed value.

The affected B.C. regions are as follows:

- Municipalities in the Capital Regional District, excluding Salt Spring Island, Juan de Fuca Electoral Area and the Southern Gulf Islands

- Municipalities in the Metro Â鶹´«Ã½Ó³»Regional District, excluding Bowen Island, the Village of Lions Bay and Electoral Area A, but including the University of British Columbia and the University Endowment Lands

- The City of Abbotsford

- The District of Mission

- The City of Chilliwack

- The City of Kelowna

- The City of West Kelowna

- The City of Nanaimo

- The District of Lantzville

More information can be found on the B.C. government’s website .