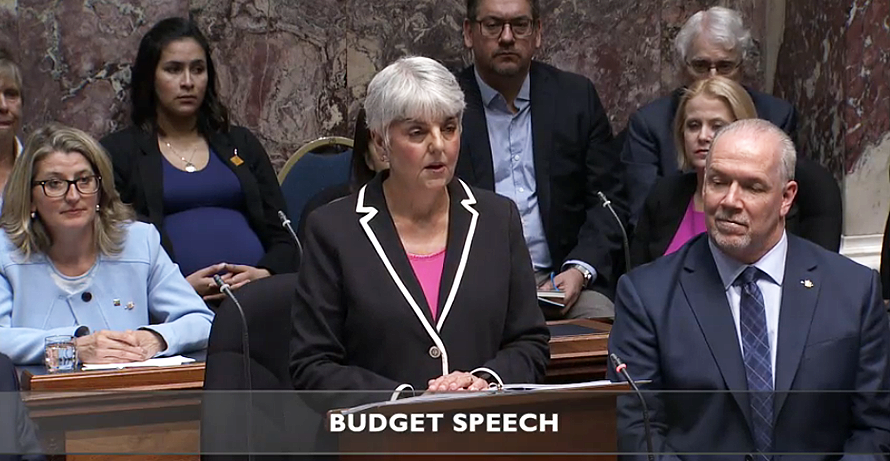

, announced by finance minister Carole James yesterday following a backlash from owners, have been broadly welcomed тАУ but do not go far enough, according to industry groups.

Although the geographical boundaries of the tax have been tweaked, the municipalities of Kelowna and West Kelowna are still included. This could be a huge problem for these tourism-driven economies, as it may result in a virtual halt in new housing, according to a statement issued by the Canadian Home BuildersтАЩ Association of BC.

CEO Neil Moody stated, тАЬWe see this tax as still hitting tourism-driven areas, even if the tax is now lowered [for B.C. residents and other Canadians]. In recent weeks, CHBA BC has heard countless stories from members who have told of contracts now being cancelled for new housing in West Kelowna and Kelowna, because of the tax. These new projects would have created jobs for many in the Okanagan, beyond just the home building companies тАУ glaziers, framers, product suppliers, manufacturers, and more. It does not make sense to focus on one area in the Interior alone. This creates a competitive disadvantage and an immediate unlevel playing field between those on the right and wrong side of the boundary.тАЭ

MoodyтАЩs statement said that he hopes the CHBA-BC and the B.C. government can work together to тАЬclarify remaining concernsтАЭ about the tax.

This hope was echoed by the British Columbia Real Estate Association, which welcomed the changes but said it looks forward to тАЬmore answers as the speculation tax takes shape.тАЭ The BCREA said it was looking for opportunities to тАЬminimize its negative impact for homeowners who pay income tax in Canada.тАЭ

The association raised concerns over the potential economic impact on communities inside the taxтАЩs geographic boundaries, stating, тАЬCommunities could face economic problems, due to fewer visitors [and] less consumer spending.тАЭ

The BCREA also said that it was unfair for owners of second homes within the City of Vancouver, where there is already an Empty Homes Tax in place. тАЬHomeowners in the City of ┬щ╢╣┤л├╜╙│╗нcould potentially be charged twice for leaving their homes vacant: once by the city and once by the province.тАЭ

It added, тАЬAlso, development properties are often bought years before they are developed, and the proposed tax would add costs that would be passed on to consumers, regardless of where they pay tax.тАЭ

The BCREA suggested that home owners could be incentivized to rent out their homes, rather than taxed for not doing so.

The association showed some optimism that there could be some further changes made to the tax by concluding, тАЬBCREA urges the BC Government to undertake a formal, public consultation on the proposed speculation tax, to ensure the best input and insights are available, and to assure those affected that this measure is being carefully considered from all angles.тАЭ

Unless a second round of changes is issued before then, more details will come to light when the enabling legislation on the speculation tax is tabled in the fall sitting of the legislature, scheduled for October 1.