The City of Â鶹´«Ã½Ó³»is reporting that the number of Â鶹´«Ã½Ó³»properties declared vacant in 2018 under the Empty Homes Tax fell by 15 per cent from 2017 and 53 per cent of those properties are back on the rental market.

The goal of the Empty Homes Tax, which was introduced in 2016, was to pressure homeowners to rent out homes they weren’t living in full time with the goal of improving the city’s low vacancy rate that sits at about .8 per cent. Any revenue collected by the city through the tax, which is implemented at a rate of one per cent of a property’s assessed taxable value, is being allocated to affordable housing initiatives.

Mayor Kennedy Stewart called the latest statistics on declarations “very encouraging,” in a press release the city issued Feb. 6.

“The main objective of Vancouver’s Empty Homes Tax is to influence property owners to put their empty properties on the rental market and the data shows that is happening,” he stated.

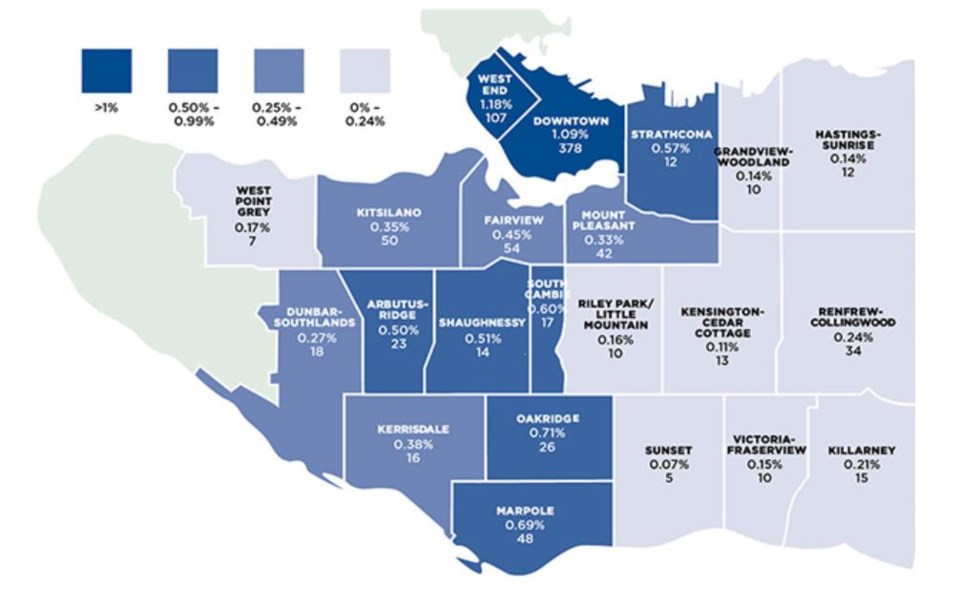

Homeowners had until Feb. 4 of this year to file their empty homes tax declarations for 2018. As of that date, 922 properties were declared vacant, compared to 1,085 declared vacant by last year’s extended deadline of March 5, 2018, translating to the 15 per cent drop.

Properties declared vacant or deemed vacant by the city if a declaration was not submitted by the deadline will be billed for one per cent of their property’s 2018 assessed taxable value. Payments are due by April 12.

During his election campaign, Stewart said he favoured tripling the Empty Homes Tax to three per cent.

In late January, he tabled a motion, which council approved, requesting city staff report back by the end of March 2019 with a plan to review and improve the fairness and effectiveness of the tax, including a possible increase to the tax rate.

Meanwhile, most property owners — 97 per cent — met this year's declaration deadline.

Beginning on Feb. 7, property owners will have the option to make a late declaration online, after they pay a $250 penalty. It’s the first time late declarations have been allowed and it's intended to help streamline the complaints process, according to the city.

All net revenue generated by the Empty Homes Tax is being dedicated towards affordable housing initiatives.

As of November 2018, the city allocated $8 million towards such projects. First-year implementation and operational costs were tagged at $10 million. At that time, the city had collected $20.6 million, with $17.4 million outstanding.

“As part of the 2019 Budget approval in December, council approved that $2.6 million be directed towards affordable housing initiatives and added an additional direction for $20 million of the Empty Homes Tax net revenue, when received, to go toward supporting ‘initiatives to address housing supply and affordability, to improve availability and supports for renters and vulnerable citizens, and to deepen affordability of social housing for people experiencing homelessness, people on social assistance and disability and people on pensions,’” Melanie Kerr, the city’s director of financial services, told the Courier in an email.

“The revenue from EHT is just one funding stream that flows into the City’s broader set of initiatives in its 10-year Housing Â鶹´«Ã½Ó³»strategy.”

This story has been updated since first posted.