Only the highest income-earners can afford to buy a home in Canada’s major cities, according to a by real estate website Zoocasa.

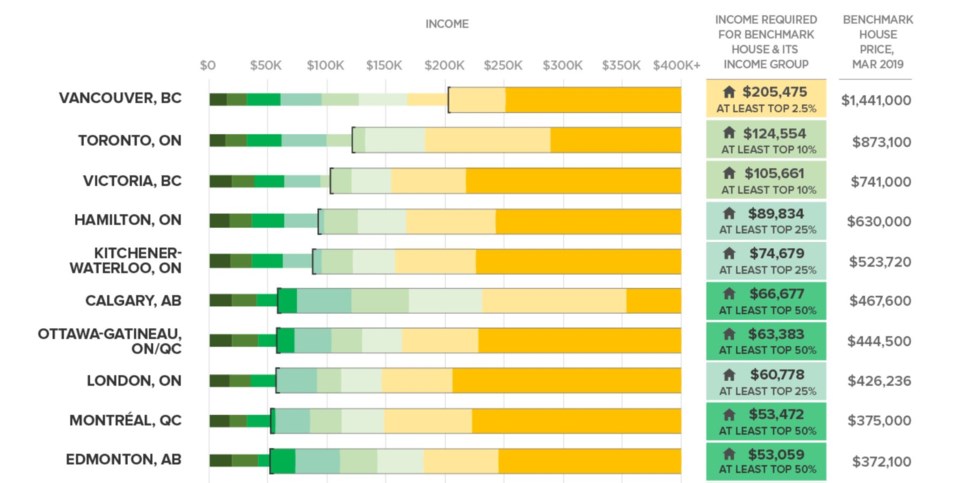

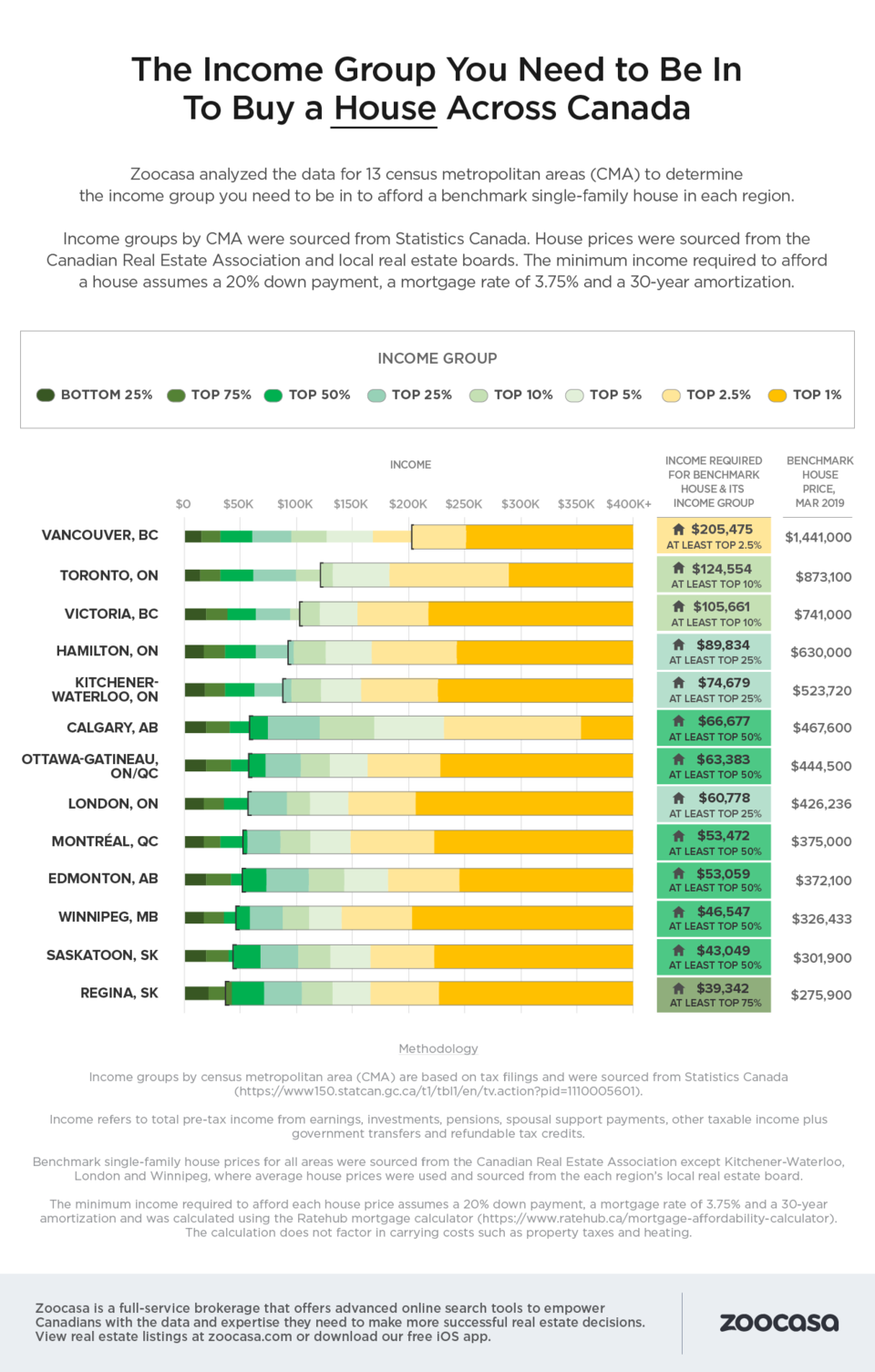

In Metro Vancouver, the affordability level was found to be – unsurprisingly – the worst in the country. Zoocasa reported that you need to be in at least the top 2.5 per cent of earners to be able to buy a detached home at the board’s benchmark price of $1,441,000. That’s an annual household income of $205,475 or more.

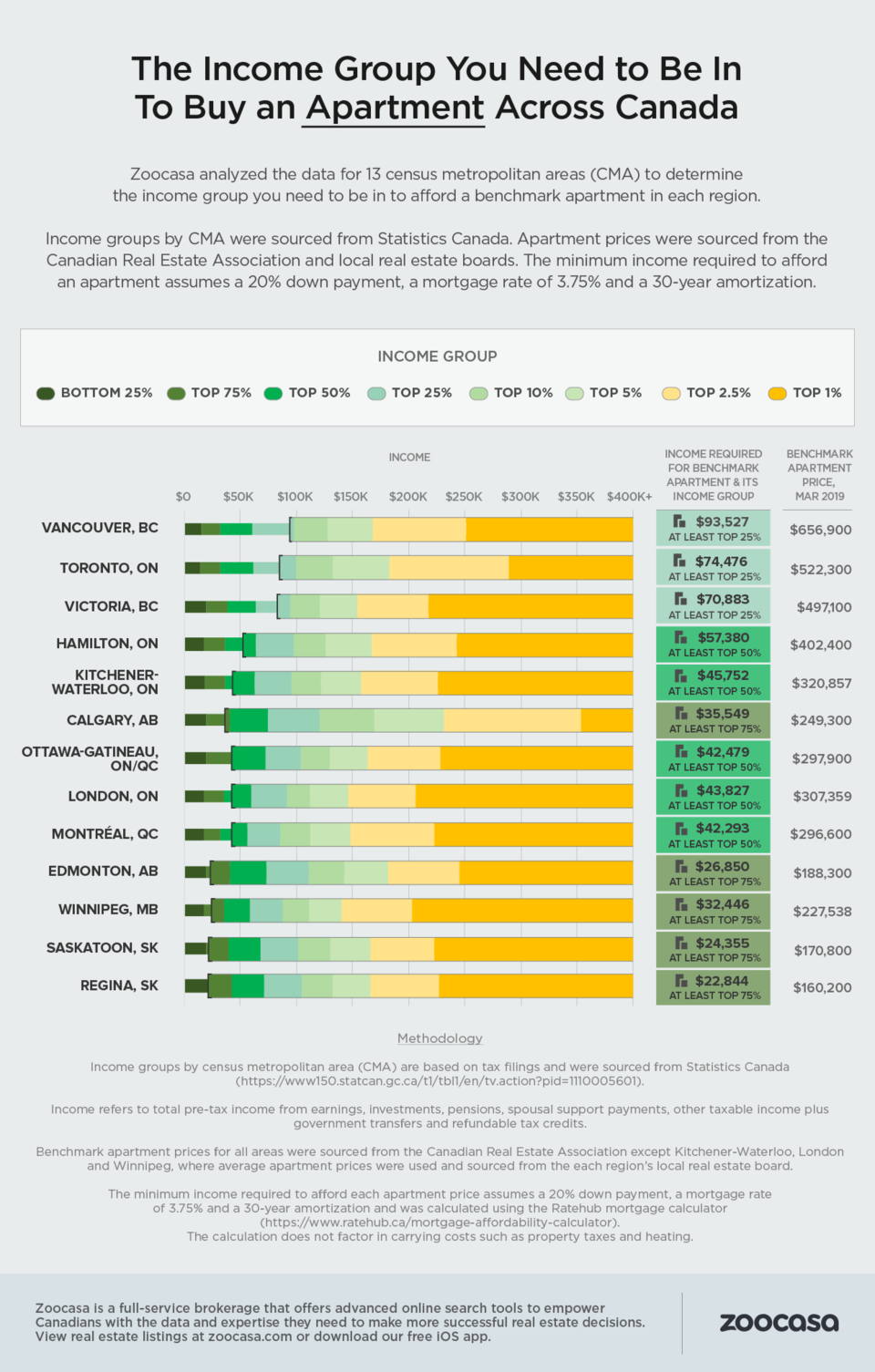

Even if you’re buying a Metro Â鶹´«Ã½Ó³»condo, you need to be in at least the top quarter of the region’s income groups to be able to afford a typical unit at the $656,900 benchmark price, earning at least $93,527 a year.

The Greater Victoria region was found to be the third-worst for affordability in Canada, after Toronto. To afford a typical $741K detached house in the region would require a salary of $105,661 – in at least the top 10 per cent of local earners.

Those buying a condo in the capital region need to be in at least the top 25 per cent of earners to afford a $497,100 typical unit – a salary of $70,883.

The study calculated the minimum income required to qualify for a mortgage in 13 census metropolitan areas (CMAs) across Canada, assuming a 20 per cent down payment, 3.75 per cent mortgage rate, and 30-year amortization.Ìý

The Prairie markets were found to offer the greatest affordability of the CMAs studied, with buyers of detached homes in Regina only needing to be in the top 75 per cent of local earners.

The study was released on the same day that Royal Bank of Canada's chief economist finding that young people are not declining in Canada's biggest cities, despite the housing affordability crisis.

Check out Zoocasa's full rankings of what you’d need to earn to buy a home in cities across Canada, in the infographics below.

Ìý