Home resale transactions across B.C. “continue to recover” from the policy shock and subsequent downturn caused by the mortgage stress test, the B.C. Real Estate Association stated September 12.

Residential property sales around the province totalled 7,093 units in August, which is 4.9 per cent higher than in August 2018

BCREA also reported that the average residential price in the province was $685,575 last month, an increase of 2.6 per cent from August 2018. The increase in both prices and activity last month meant that total sales dollar volume was $4.86 billion, a 7.6 per cent jump from the same month last year.

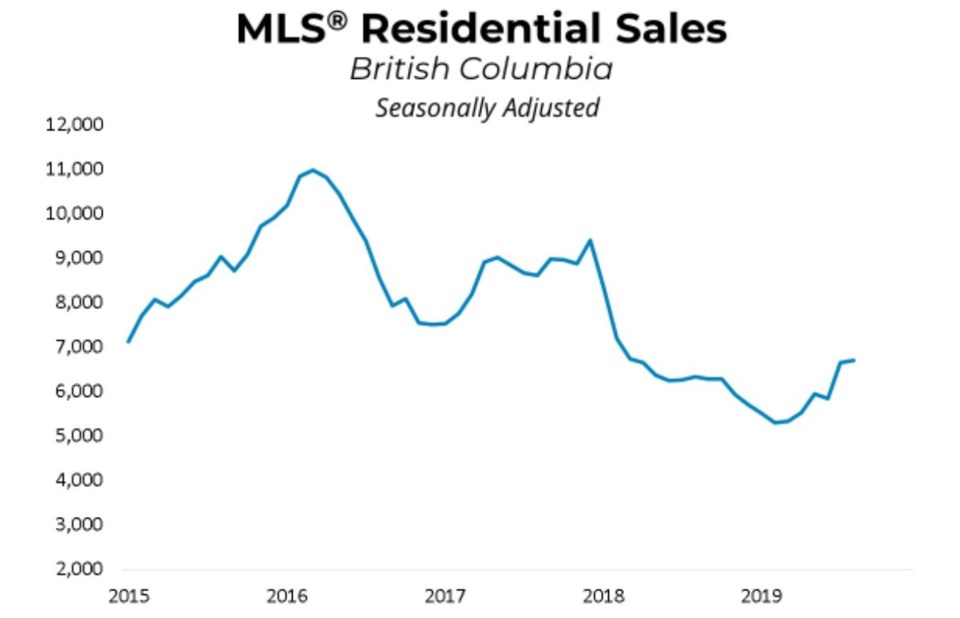

The graph below shows how policy announcements have affected the province’s real estate market, with the foreign buyer tax introduced in August 2016 (although sales were falling from the first half of 2016) and then sales falling off a cliff in January 2018, when the mortgage stress test was launched.

“B.C. home sales continue to recover from a policy-driven downturn,” said Brendon Ogmundson, BCREA’s deputy chief economist. “Home sales have been rising through the spring and summer, but still remain well below pre-B20 stress test levels.”

The association also reported that “overall market conditions remained in a balanced range with a sales-to-active listings ratio of about 18 per cent.”

The August sales and price statistics follow BCREA’s September 5 into 2020. It predicted that the slow sales in the first half of the year would bring the province’s overall activity through 2019 down, but that sales and prices would both modest recover in 2020.

To read the full August sales, price and listings statistics broken down by each B.C. board region, click .