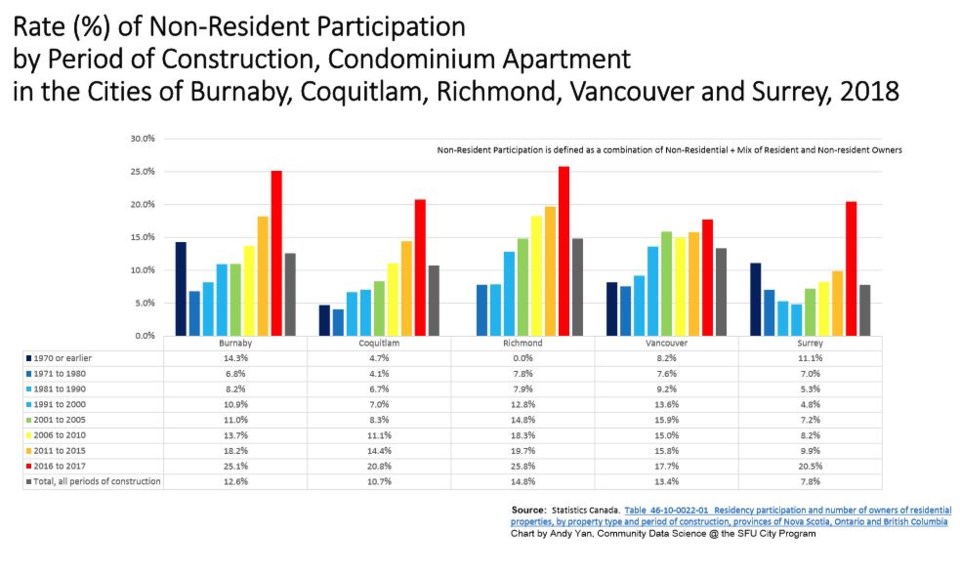

One in four condos built in Burnaby in 2016 and 2017 are owned by foreign residents, recently released data shows.

The statistics from the Canada Housing Statistics Program show a higher rate of non-resident participation in the local real estate market compared to previously released figures.

Overall, non-residents owned or were partial owners of 12.6 per cent of all condos in Burnaby when the data was captured in 2018. Only �鶹��ýӳ��and Richmond had higher rates of non-resident ownership in the region.

And the data tells a similar story in the single-detached home market. Non-residents owned more than a quarter (25.8 per cent) of homes built in 2016 and 2017 – far higher than the regional average of 10.4 per cent in Vancouver’s census metropolitan area.

“The story is really how much non-residents really have a role,” said Andy Yan, director of Simon Fraser University’s City Program. “It gives you the context of what are some of the factors of demand and the types of demand that is helping drive the kind of supply that is happening in the City of Burnaby.”

The data doesn’t necessarily show foreign ownership, he said. The statistics track non-resident participation – properties where one or more owner is not a tax resident of Canada.

“That person, for example, could be that (Canadian) English teacher in Japan who happens to hold a pied-à-terre in Burnaby,” Yan explained. “But, at the same time, it's also where the foreigners with no ties to Canada could also be.”

Effect of policies unclear

Yan said the 2018 data is likely too old to show the full effect of B.C.’s foreign-buyers tax that came into effect at 15 per cent in 2016 and was later raised to 20 per cent.

Overall, he said, “we’re just starting” to properly address foreign investment in B.C.’s real estate and its inflationary effects.

“I think the movement towards greater transparency, accountability and, indeed taxation, is part of those moves," Yan said.

But, he said, there are existing powers to address the issue that are perhaps not being properly enforced.

When a non-resident sells property, the buyer is supposed to withhold 25 per cent of the gross sales price and remit it to the Canada Revenue Agency (CRA). The intent is to ensure non-residents pay the appropriate income taxes.

Non-residents must notify the CRA within 10 days of selling a Canadian property. The agency then charges the applicable taxes on the capital gains received by the seller. Once those are paid, the CRA issues a certificate of compliance and what remains of the 25 per cent withheld amount is returned to the seller.

Yan said there are questions about how well the withholding system is being enforced.

CRA underfunded, backlogged: lawyer

Ron Usher, general counsel for the Society of Notaries Public of B.C., said the withholding rule is a good method of ensuring non-residents pay their fair share of taxes, but the questions around proper enforcement come from a severe backlog.

While the CRA sets clear and strict deadlines for buyers and sellers alike to submit forms and remit money, he said the agency is much slower to respond.

“I just put it down to woeful underfunding of CRA and that's not the individual CRA employees’ fault – that's political decision not to properly staff CRA,” Usher said.

But a CRA spokesperson, Heidi Hofstad, said in most cases sellers notify the agency of the sale in time and buyers are not required to withhold money.

'Huge' tax leakage from rentals

Usher said there is likely far more tax revenue being lost to non-resident owners who rent out their properties without paying the appropriate income tax. That’s because Canadian law does not require non-residents to report ownership at the point of acquisition.

“If there's any place where there's a huge leakage, it's in the rental income from places owned by non-residents,” Usher said. “I'd be shocked that there's not an awful lot of rent being collected that is not being properly reported to CRA.”

Usher said he hopes the CRA uses data collected by B.C.’s new speculation and vacancy tax to identify non-resident owners earning rental income.

The CRA does have an agreement with B.C. to share data from speculation tax declarations, Hofstad said. She said the provincial data is part of a broad set of strategies the agency uses to identify non-compliance with Canadian tax law.

“The CRA is committed to making sure that individuals and businesses, including non-residents, are aware of their tax obligations, and that they comply with them,” she said. “Tax non-compliance affects the services and programs we all rely on to improve our quality of life, and the CRA takes the abuse of the Canada’s tax laws very seriously.”