Greg Martel investors who had been hoping a court date today might shed some light on where their money went and if there is any chance of recovering it are likely to be disappointed.

The court date, where they are expecting an update from the trustee overseeing the bankruptcy of the Victoria mortgage broker’s company My Mortgage Auction, will offer little new information about where $226 million in investments went.

According to PricewaterhouseCoopers’ fifth report to the court on the My Mortgage Auction bankruptcy proceedings, released on the eve of the court date, Martel’s legal counsel intends to argue Martel should not provide further information to the receiver.

The report notes Martel’s lawyers, Helen Sevenoaks and David Wotherspoon, have written to the receiver on a number of occasions to say they are concerned the requirement for their client to provide information could be used in a proceeding in the U.S., putting him in jeopardy.

They’ve said they will be applying for a constitutional exemption to relieve Martel from the obligation to produce further documents and information to the receiver.

Martel’s counsel has also requested that the receiver not refer to any information provided by Martel in its reports and remove materials from its website.

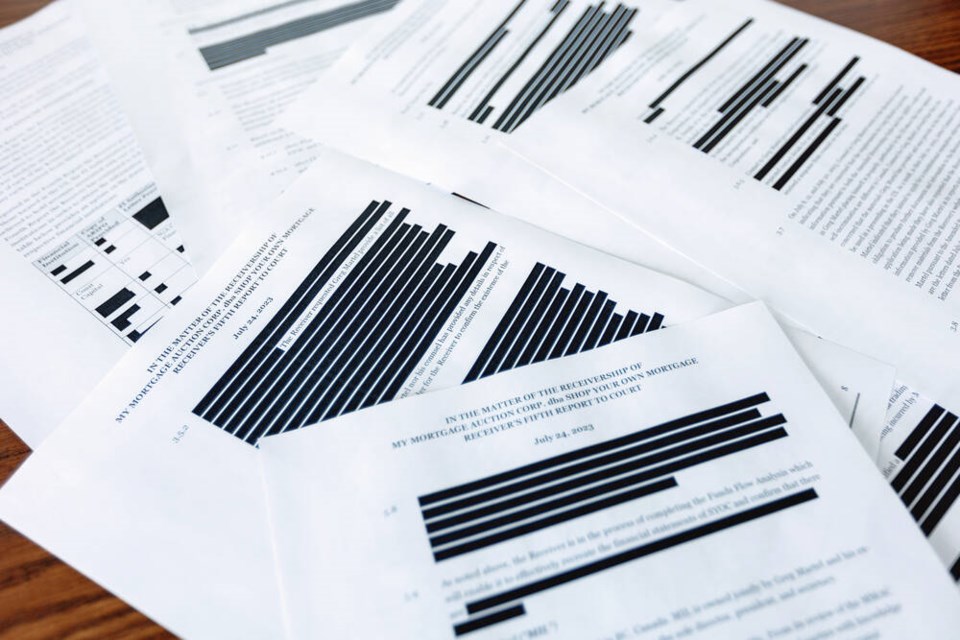

While the receiver has complied by heavily redacting its fifth report, it also pointed out the “quantum of information provided by Greg Martel, which has not been obtained from other sources by the receiver, is minimal.”

In a note to investors posted to its website, the receiver noted Martel’s counsel intends to ask the court to seal the redacted portions of the report and if that happens, portions of the report will remain confidential.

If the court does not approve the sealing order, another version of the report will be posted.

In its report, the receiver notes it has had no direct contact with Martel in a month, as he has opted to communicate through his counsel. It also points out it still has no documentation that supports the bridge loans that represent the single largest group of assets of My Mortgage Auction.

Despite repeated requests, Martel has yet to provide the receiver with the names of the borrowers, the locations of the borrowers and the amounts of the loans.

The short-term loans, which Martel and his company claimed were for construction projects, were funded with an estimated $226 million from 1,200 investors.

Through nearly three months of investigating, the receiver has only recovered $302,266 to date.

The one glimmer of hope included in the receiver’s latest report is there is an application now before the courts to have Martel declared bankrupt. That would allow a receiver to be appointed and take control of assets in Martel’s name. Those assets could then be sold, with the proceeds provided to the investors.

There is a court date set for Aug. 8 in Victoria to consider that matter.

Because of the limited funds recovered so far, the receiver will be applying to the courts this week to borrow $400,000 from Martel’s investors for an asset-recovery initiative in the U.S. The receiver says it needs the funds for U.S. court applications to have Canadian court orders freezing Martel’s assets recognized.

PricewaterhouseCoopers said it must move quickly to ensure it can secure and sell Martel’s Las Vegas property, which could bring an estimated $1.8 million to the investor pool.

The receiver noted that without funding, the trustee will likely lose the ability to pursue the Vegas property, as a group of five Martel investors have begun proceedings in Nevada courts that could result in the seizure and sale of that property.

The receiver will also be asking the court this week to extend its investigatory powers order until the end of October. At this point, they are due to expire at the end of July.

The receiver said an extension would allow it to continue its fund-flow analysis to determine if recoverable assets exist and if the bridge loans ever existed.

The time-consuming analysis is an attempt to reconstruct the financial records of My Mortgage Auction by analyzing transactions on all available bank statements.